Updated for 2021. You may want to think twice before taking the old saying cash is king too literally. In the low interest rate environment of the last decade, holding cash will yield a real negative return (after inflation and taxes). Yet there are circumstances where it is advisable to stay liquid. Here are a few ways to tell if you’re holding too much cash and some ways you can put your cash to work for you. Regardless of whether you have too much cash on hand, consider keeping your money in a high-yield savings account. These days, there are very few reasons to keep a significant amount of money in an account paying no interest.

Do I have too much cash? How much should I have in savings?

Whether you have recently experienced a liquidity event from a windfall or have just saved diligently over the years, holding too much cash is one of the top five biggest risks facing investors today. Since every investor will have varying liquidity needs and cash balance comfort levels, perhaps the best way to determine whether you are carrying too much cash is to first estimate a minimum cash balance.

In general, one-income households should have between 6-9 months of essential expenses in savings. Dual income families usually need less, around 3-6 months in emergency funds. If you’re saving for a down payment in a year or two, you’ll need more in cash. Also, if you’re a business owner, you’ll also need more in savings than an employee would.

Take a look at your entire financial situation, or work with a fee-only financial advisor to determine exactly how much savings you should have.

Why keeping too much cash is a bad thing

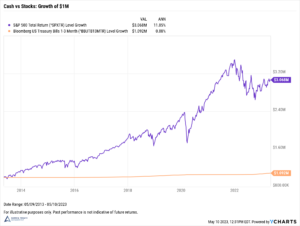

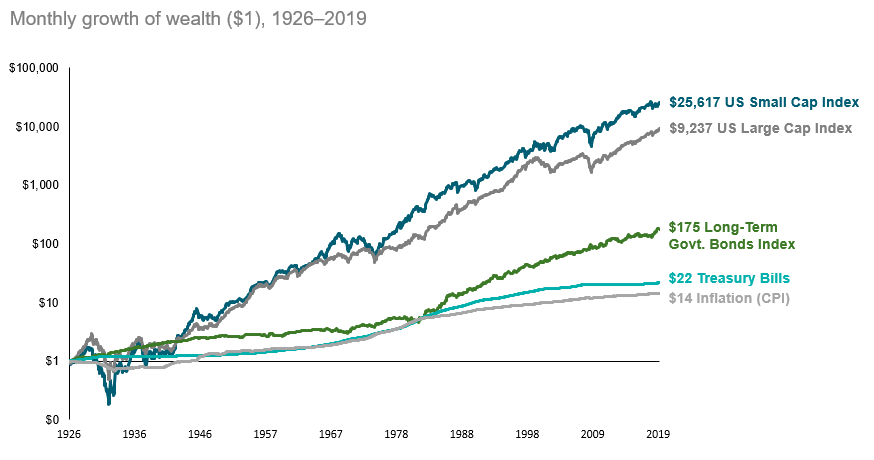

The biggest risk in keeping too much cash on hand is the opportunity cost. Even in periods of higher interest rates, which we’re not in, the real return on cash after taxes and inflation can be negative. Over the long run, only the equity markets have the potential to earn returns that outpace inflation. That’s often the difference between having enough money to retire, and not.

If you invested $1 in Treasury Bills (proxy for cash) in 1926, by the end of 2019 you would have $22. If you invested a dollar in the S&P 500 in 1926 instead, you’d have $9,237 by the end of 2019. Obviously stocks carry greater risk, but unless you have A LOT of cash or other sources of income, you really need to invest cash to make it work for you.

Growth of Cash vs Stock and Bonds

If you don’t have emergency savings, you’re probably not keeping too much cash

Emergency funds should be kept in cash and fully liquid. Investing an emergency fund in the stock market carries a risk of loss due to market downturns. Certificates of deposit (CDs) are generally not a good way to keep emergency cash either, as the funds cannot be accessed until the maturity date.

In general, unmarried investors should have roughly six months of non-discretionary living expenses in cash emergency reserves. Non-discretionary living expenses include food, housing, insurance, and so on, essentially the minimum monthly amount you would need to survive and get back on your feet. Married investors in a dual-income household should have at least three months of non-discretionary living expenses in cash.

Households with children should have more saved up, particularly if there is only one working spouse or one parent with access to benefits like health insurance. Always adjust these basic guidelines to fit your situation as many factors will impact your required reserves.

You may not have too much cash if you’re still saving for upcoming major purchases

A separate consideration from emergency reserves is whether you have a major purchase, such as a down payment on a home, on the horizon. Generally, if you are saving to reach a goal within the next five years, consider keeping your reserves in cash. While the stock market can be expected to go up and down over the long run, investors have a much longer time horizon to recover from a downturn. Short term goals will have a much greater sensitivity to the market.

What to do if you have too much money in savings

If you have emergency funds and aren’t saving for any short-term goals, you’re probably holding too much cash. This is a good problem to have!

You will have several options to use your extra savings including refinancing your mortgage, saving for retirement, investing with a brokerage account, and paying off other debts.

5 ways to use extra savings

- Invest excess cash using a brokerage account

- Increase contributions to a 401(k), 403(b), or IRA

- Consider using the funds to pay the tax on a Roth IRA conversion

- Refinance your mortgage

- Pay off student loans or bad debt

Read more about ways to use extra savings.

If you are holding too much cash, consider working with a wealth management professional to develop an investment management strategy consistent with your goals.