Growing up, kids are taught very simple facts about money: you need to earn it to pay your bills and save it to retire and buy things you want along the way. Yet, as we get older, these basic facts about money seem to have gotten lost. Instead of emphasizing working and saving to reach your goals, the story has changed. Trendy and complex investment strategies have taken center stage, luring investors with notions of passive income, astronomical returns, and making a “sure bet” on the next new thing. The problem is, this story is often a fairy tale, only without a happy ending. So why do we continue to tell it?

It is hard to go a day without hearing the news media discuss en vogue investment strategies like real estate, Bitcoin/cryptocurrency, alternative investments, private placements, or bets on single stocks. The problem is that many of these investments are rooted in the belief that the widely accepted risk/reward framework must be somehow misaligned, providing you with an investment option that is unavailable or unknown to everyone else. And by speculating with your own dollars, you’ll find an elusive shortcut on the path of wealth creation.

Beware of shortcuts

We all want to build wealth, enjoy our lifestyle, and have money to retire. If you asked a middle-schooler how to boost savings, you’d probably get a pretty simple answer: make more money or spend less of it. So why do we complicate things as adults?

While saving may be the obvious choice, in today’s “on-demand” economy, it becomes a last resort. Perhaps it’ll take too long to require a change in lifestyle spending, leading some investors search for a shortcut.

It’s a lot like dieting: rather than take a prudent approach to weight loss, like eating healthy and exercise, some folks may prefer to have surgery or find a “miracle” pill or 3-day fast that won’t require an ongoing lifestyle change. Saving money, like diet and exercise, takes time and sometimes sacrifice to see lasting results.

Have some people been successful with these “alternative” strategies to weight loss? Sure. Have some people made their fortune by betting the proverbial farm on a real estate investment? Of course. But we’ve all seen it go the other way. We know the horror stories of medical complications and bankruptcy filings following a highly-leveraged real estate deal.

Those headlines wouldn’t shock you. But when was the last time you read a dire headline such as: “Couple Who Maxed Out 401(k) for 20 Years in a Well-Diversified Portfolio Loses Everything in Market Crash”?

No investment can hide from dips in the market, but choosing a risk-appropriate and diversified strategy can help investors reduce their exposure to unnecessary and devastating losses.

Before making any kind of investment, consider whether the risk and reward proposition makes sense on its most basic level. Then, consider what the objective really is. Setting aside funds in a “play” account to trade single stocks is one thing, but when it comes to building and preserving wealth over the long-term, a proven and pragmatic approach is often the best way to go.

Complicated means expensive, not better

Some strategies have emerged as a kind of status symbol over time, where the idea of participating may hold as much value to an individual as the potential return. These types of investments, typically private placements, hedge funds, illiquid investments in real assets, commodities or options trading, specifically target investors of a certain socio-economic profile. This exclusivity factor can play into an investor’s ego and the idea that this is how the “wealthy” invest.

Unfortunately, the idea that the “best” investment strategies are complicated or privy to few is inaccurate. In truth, these methods often carry high risk, considerable operating expenses, and very limited liquidity, which prevents you from getting your money out.

Above all, costs drive performance

Even sticking to publicly-traded investments, it can be easy to get carried away with costly strategies seeking to beat the market, most notably stock picking and using actively managed mutual funds.

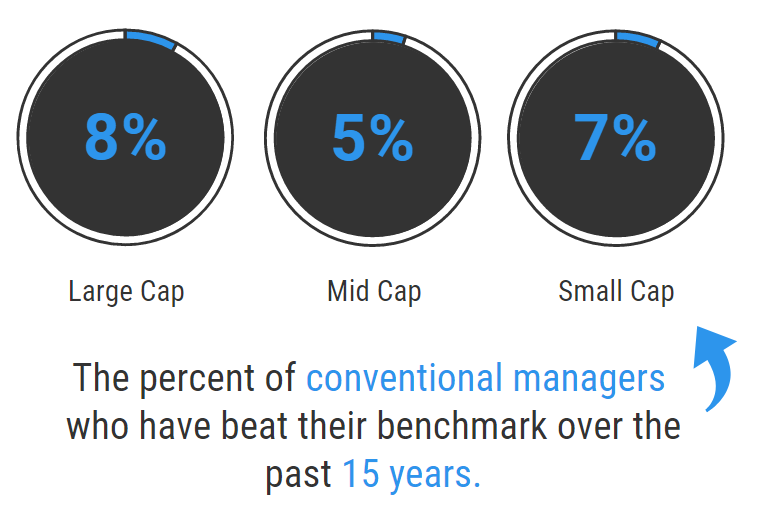

There have been numerous studies done to show that on an expense-adjusted basis, lower cost (usually passive) funds have outperformed their conventional managers, which come at a higher cost.

The story is fairly simple here. No one can predict what is going to happen in the market, certainly not with any regularity.

Source: S&P Indices Versus Active ending December 2016

When active managers try to beat the market, it is very costly, as a number of highly educated individuals need to get paid. This results in a higher expense ratio for the fund, compared to its passive counterpart. Fund expenses aren’t top of mind for many investors because they don’t “see” the costs, as they’re deducted from fund assets. But don’t be fooled – the costs are eating directly into your returns.

Using our example from earlier, to save more money, you basically have two options: make more or spend less. After expenses, the overwhelming majority of stock-pickers fail to earn greater returns for their investors compared to low-cost passive funds. Since we don’t really have much control of how much we “make” in the market, we should then shift our focus to what do have some control over: how expensive our investment strategy is.

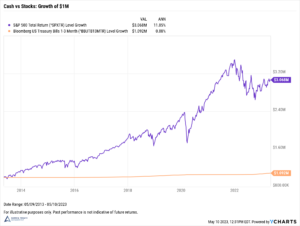

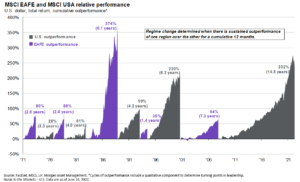

Market timing can seriously erode investment returns too. Between 1997 and 2016, a disciplined investor in the S&P 500 would see a 7.7% annualized return. If that investor ended up going to cash for a short period, missing the 10 best days in the market over this time, their annualized return would plummet to 4%. The market can turn on a dime; over this 20-year period 6 of the 10 best days were within 2 weeks of the 10 worst days on Wall Street.

Changing the narrative about how we think about money and our views on investing can play a significant role in how successful we are in reaching our goals. Building and preserving wealth requires patience and discipline. Make saving a priority and don’t pull out of the market when it takes a dip. Corrections can be scary for investors, but it is actually a good thing for the market overall. When valuations soar for too long without restraint, well, then there may be a cause for concern.