If a deferred compensation plan a good idea? A nonqualified deferred compensation plan (NQDC) or supplemental executive retirement plan (SERP) allows executives to defer income until a later date, therefore avoiding paying income tax until the money is paid out. While the cash is in “deferral mode,” you can select from a plan-specific menu of investment choices to capitalize on tax-deferred growth. Sounds a lot like a 401(k) so far – but here’s where they diverge.

A deferred compensation plan is much more restrictive than a 401(k) plan. There are specific rules about the timing and nature of your future withdrawals. And most significantly, the money is not secured from your creditors or your company’s creditors in bankruptcy. If you’re wondering if you should participate in a deferred compensation plan, consider whether the risks are worth the potential rewards.

Why use a nonqualified deferred compensation plan?

At a very high level, NQDC plans combine certain key benefits of a 401(k) plan and a Roth IRA: participants are able to reduce taxable income in the current year, enjoy the compounding effects of tax-deferred growth, and may be able to bypass required minimum distributions by agreeing to the distribution schedule set forth in the plan description.

Essentially, in order for participation in a deferred compensation plan to make sense financially, employees should expect to be in a lower tax bracket in the future than they are today, which combined with the additional years of tax-deferred growth, may make this reward seem worth the risk associated with locking up the funds with their employer.

How deferred compensation plans work

Nonqualified deferred compensation plans are often offered to high-earning employees and executives, as a way to defer additional income on a pre-tax basis. Since 401(k) plans limit your annual contributions, NQDC plans can help supplement savings, as there is no limit.

When you choose to participate in a deferred compensation plan, the portion of your pay that you elect to defer will be made available to you at a future date, as specified in the plan documents. Sometimes the plan may allow deferral for short periods of time, perhaps a few years, while others may stipulate that funds will be unavailable until retirement.

Once you’re eligible to withdraw the money, the plan provisions may include specific language about when and how you may take it. Some plans don’t allow distributions if you change jobs. For this reason, these plans are an example of “golden handcuffs.” Others may force you out over a period of years once you terminate, with taxes due on the distributions.

The rules governing nonqualified deferred compensation plans are very plan-specific, so be sure to read your plan description entirely before deciding whether to enroll. SERPs can be very restrictive, severely limiting your ability to access your money after making the irrevocable election.

Frequently asked questions about deferring compensation in a supplemental executive retirement plans

What if you want to access the money early?

Generally, deferred compensation plans don’t allow flexibility in this regard, as you made an irrevocable election when signing up to participate in the plan. Unlike a 401(k) plan, you cannot take a loan. In some plans, job separation may trigger a disbursement.

Is there an annual limit on how much you can contribute?

There is no IRC limit on annual additions to a SERP plan, but there may be limits at the plan level.

What are the investment options?

The investment choices will be plan-specific. Nonqualified deferred compensation plans may offer the same fund lineup as the company 401(k) plan or another menu. This is another restriction of deferred compensation plans, as you are limited to the choices offered through the plan which could be mostly actively managed mutual funds with few low-cost options.

Is my deferred pay secure?

In short: no. Nonqualified deferred compensation plans allow for deferred taxation as long as the money is considered at a “substantial risk of forfeiture.” Deferred compensation is not protected from creditors in the event your employer files for bankruptcy. The funds are also not secure in the event the employee files for bankruptcy.

Do supplemental executive retirement plans have required minimum distributions (RMDs)?

There are no IRC rules about distributions at age 72 but plan rules are possible.

Can you take the money with you if you change jobs?

Maybe. Whether you can do a rollover will depend on a number of factors. For example, whether your plan allows distributions upon separation of service, how long it’s been since your last contribution, the reason for your job transition (e.g. layoffs, merger or acquisition, disability, reduction of hours, termination, etc.), and the financial health of the company.

Review the plan documents to see if deferred compensation assets may be paid out if you voluntarily leave the company. Supplemental executive retirement plans can become very complex in certain situations, many of which may be out of your control.

What if the company files for bankruptcy?

In the event of bankruptcy, there is a real chance that some/all of your deferred compensation will be lost. Even if you leave the company with your cash before bankruptcy, in certain cases, the court can claw back these funds if you had prior knowledge that your employer was no longer a going concern. Each situation will be unique to the facts and circumstances of that particular case; consulting an attorney is highly recommended in this situation.

What can happen if the company is bought out?

There are a number of different possible outcomes in this situation. Unfortunately, although the question may be simple, the underlying rules are very detailed and outside the scope of this article. At a high level, depending on the nature of the transaction (IPO, stock sale, asset sale, or change in control) and whether the employee continues employment, the supplemental executive retirement plan may be continued, accelerated and paid, or terminated.

If the plan terminates, you’ll likely receive the entire amount in a lump sum. This may trigger a huge unforeseen taxable event.

Are there any alternatives to deferred compensation plans?

Try automating your savings each month. Set up a bank or brokerage account at a financial institution you don’t regularly use, and schedule automatic transfers to match pay periods. This simple strategy is highly effective – even some pro athletes with multi-million dollar deals save this way.

Nonqualified deferred compensation plan vs a 401(k)

Nonqualified deferred compensation plan vs a 401(k)

A 401(k) is a type of qualified deferred compensation plan. Its nonqualified counterpart still shares many of the core features of a 401(k). SERP plans offer savings well in excess of a 401(k), but they are inflexible in several other ways. Here are a few ways deferred compensation plans compare to a 401(k).

How a deferred compensation plan is the same (or similar) to a 401(k) plan

- Pre-tax contributions

- Money grows tax-deferred

- Investment options

Differences between deferred compensation and 401(k) plans

- Contribution limits. Executives can only contribute $19,500 in a 401(k) in 2021 (increasing to $20,500 in 2022) plus $6,500 if age 50 or older. Nonqualified deferred compensation plans don’t have limits unless imposed at the plan level.

- When you change jobs. When you have a 401(k) and switch jobs, you can roll the account over to an IRA. With a SERP, you may not be able to take the funds. Distributions after you quit or change jobs will depend on the plan rules.

- Required minimum distributions. 401(k)s require RMDs at age 72. Like other aspects of deferred compensation plans, whether RMDs are required or not is decided at the plan level.

- Money in a nonqualified deferred compensation plan doesn’t have the protection of a qualified plan, like a 401(k). Unlike a 401(k) plan, which is completely independent of the sponsoring employer (unless your 401(k) is invested in company stock), contributions to a deferred compensation plan are unsecured loans to your employer that they promise to pay you. The risk is greatest when the plan is unfunded.

- Irrevocable funding. 401(k) contributions are voluntary and flexible; NQDC plans require an irrevocable annual election

What are the pros and cons of nonqualified deferred compensation plans?

Although there a number of risks associated with supplemental retirement plans, there are benefits in some situations. Keep in mind, there are many elements in the analysis that you can’t control when you participate. This is an added risk when making an irrevocable election to defer a portion of your pay.

Additional tax-deferred growth

Deferred compensation plans are popular among highly paid executives. Relative to income, the maximum annual contribution to a 401(k) is quite low. It’s nearly impossible to maintain the same lifestyle in retirement without saving aggressively outside of your 401(k).

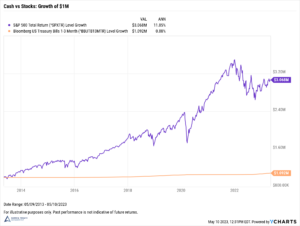

Through the benefits of compounding, investing with pre-tax dollars can produce greater returns than after-tax over time. Assuming you fall into a lower tax bracket in retirement, using a supplemental retirement plan can be attractive. Keep in mind, it’s possible to have too much of a good thing. If all of your assets are in pre-tax accounts, you’ll lose tax planning opportunities in retirement.

Ability to exclude larger amounts from taxable income

For highly paid executives, the standard 401(k) contribution isn’t going to reduce taxable income in a meaningful way. A deferred compensation plan can help solve that problem, but the risk of losing the money entirely cannot be overemphasized. Be careful not to let the tax-tail wag the dog. After all, paying more tax on income you earn and receive is better than paying no tax on income earned but never received.

Forcing you to save

Saving can be a challenge at any income. For highly paid workers who frequently engage in lifestyle inflation as their income increases, deferring compensation can help keep spending under control.

Disciplined investors can achieve forced savings without a SERP, though. Consider setting up regular monthly contributions to a brokerage account. This will give you the flexibility to invest the money and use it when you need it. While all investments carry market risk, a taxable investment account isn’t just an IOU from your employer.

There’s no doubting the benefits of tax-deferred growth. However, don’t discount the value of liquidity and flexibility. By paying taxes on your income today, and investing the rest in a brokerage account, you can benefit from exposure to the market as well as flexibility in case you have unexpected cash needs.

Consider state income tax rates now and in retirement

Are you working in a high-tax state but plan to retire in a state with low or no income tax? If so, a nonqualified deferred compensation plan could give you a greater tax benefit, as you avoid tax now at higher rates.

This isn’t riskless though. Your plans may change and there’s no way to tell what the tax code may be in the future. Always focus on what you can control.

Loss of flexibility for tax planning today

Tax laws can change at any time, especially these days. Executives who participate in a deferred compensation plan may be frustrated if they’re missing out on realizing this income while tax rates were lower following the 2017 changes. Tax savings should be a component of the decision to participate, but not the main driver.

Avoid required minimum distributions, maybe

Investors with money in tax-deferred accounts like a 401(k) or a traditional IRA must begin required minimum distributions (RMDs) at age 72. Since withdrawals are taxed as ordinary income, RMDs can push people into higher tax brackets.

If a SERP plan does not require distributions at your RMD age, this could be a way to continue tax-deferred growth or extra income before RMDs.

Treat the cause not the symptom. Keep in mind that funds from a nonqualified deferred compensation plan will also be taxed as ordinary income when withdrawn. Since RMDs will never stop once they’ve started, the overlap will likely have a negative impact on your tax situation. Instead, consider using different types of accounts to add tax diversification.

A brokerage account has no RMD requirement. But, you’ll pay tax each year at potentially lower capital gains tax rates, depending on your holding period. And because assets left to heirs receive a “stepped up” cost basis, it’s a very tax-friendly way to leave a legacy. Also, by drawing from both tax-deferred and taxable assets in retirement, it can help provide flexibility to manage your tax situation in retirement and even harvest losses to offset gains.

Is a deferred compensation plan a good idea?

Whether or not a nonqualified deferred compensation plan makes sense for your individual situation will depend on many factors. One of those key determinants is how diversified your assets are in general, and how much financial exposure you have to your employer. In general, no more than 10% of your net worth should be concentrated in one stock, whether it is your home, an asset class or stock, or ownership interests in a business.

Executives may unknowingly have a great deal of financial risk through their employer. Aside from the salary, benefits, and other perks provided by the company, employees are also exposed through stock options and equity compensation, having company stock in their 401(k), and participating in an employee stock purchase plan.

Choosing to lock up a portion of your cash compensation for an “unguaranteed” payment later can be a big risk. Rather than prioritize tax savings, consider the opportunity to diversify in a low-cost tax-efficient investment strategy. After all, achieving your personal goals should be the central priority.

Darrow Wealth Management is an independent registered investment advisor and fiduciary money manager. As a fee-only financial advisor, we do not sell securities, insurance, or receive commissions. Learn more about Private Wealth Management for individuals and families.

Nonqualified deferred compensation plan vs a 401(k)

Nonqualified deferred compensation plan vs a 401(k)