How much can refinancing your mortgage save you?

Mortgage rates are currently very low – the average 30-year mortgage is now below 3%. It might make sense for homeowners to consider refinancing. How much could you save from refinancing your mortgage? Here’s how to tell if refinancing your mortgage is worth it. This article will explore much can refinancing save homeowners and when to consider it.

Rates are at historic lows

Average interest rates on a 30-year mortgage over the last 25 years.

source: tradingeconomics.com

Here’s the average rate on a 30-year mortgage over the last 12 months.

source: tradingeconomics.com

8 factors that impact how much you’ll save by refinancing your mortgage

There are many factors that impact the cost-benefit relationship to refinancing a mortgage.

Here are a few:

1. How long you’ve had your current mortgage

When you first start payments on a fixed-rate mortgage, most of your payment goes to the interest expense. As time passes, more of your fixed monthly payment will drift towards paying down principal. As such, newer mortgages may have greater savings over the loan life if they can avoid paying interest at higher rates entirely.

2. Your current loan balance

Older mortgages will generally have a current principal balance (to be refinanced) that is much smaller than their original loan. When you refinance, your loan is re-amortized using your current balance. This can dramatically lower your monthly payment. The 2017 tax reform limited the mortgage interest deduction to loans up to $750,000 for all mortgages issued after 12/15/17. However, older mortgages can still deduct interest for loans up to the old $1M loan limit. Refinanced mortgages that currently fall under the old limit can maintain their grandfathered status, provided the new loan doesn’t exceed the balance on their existing mortgage (e.g. a cash-out refinance).

3. How much higher is your current rate from the refi rate?

The bigger the spread the greater the potential for dramatic cost savings. There is no spread that can tell you whether it is or isn’t worth refinancing. You will need to consider all of the factors on this list and run the numbers for your situation.

4. Closing costs

Closing costs are generally .75% – 1% of the loan. You’ll want to make sure you stay in the home long enough to at least breakeven. Cashless refinancing in exchange for a higher interest rate will cost you more over the life of the loan. If you roll the cost into the loan balance, the additional debt isn’t tax-deductible as it exceeds the existing loan, and it will also add to your overall cost. To calculate how long it will take to recoup your closing costs, divide the expected closing costs by the monthly savings from refinancing.

5. How long you plan to own the home

You’ll want to recoup the cost of refinancing and justify the time/effort required to do it. The longer you own the home the more you can benefit. But even shorter ownership periods can pay off as interest expense gets smaller over time. Typically, you’ll want to own the home for at least another few years. If your home is in a trust, you will probably need to take it out of trust before you refinance, and put the house back in trust after the refinancing is done. This will increase the cost and hassle of the process.

6. Refinancing could hurt your tax situation

In 2021, the standard deduction is $25,100 for married couples (half for single filers). Given that state and local taxes are limited to $10,000 per return, mortgage interest is usually the extra push that allows taxpayers to itemize their taxes so they can benefit from charitable deductions and other deductions only available to itemizers. Could refinancing preclude you from itemizing your deductions? Consult your CPA to discuss how refinancing could impact your tax situation.

7. What you plan to do with the monthly savings

One component of the overall benefit calculation is how you plan to utilize the extra cash that is available by refinancing into a lower monthly payment. Using the funds to pay down high interest debt or saving and investing towards your other financial goals can compound the benefits of refinancing. Utilizing monthly savings can be especially important to benefit from refinancing an older mortgage.

8. How many years are left on your current mortgage? Pros and cons of refinancing into another 30-year loan

After 2017 tax reform, when homeowners refinance the allowable interest will only be deductible for the remaining term of the debt that was refinanced. For example, if you have a 30-year mortgage with 15 years left, and refinance into a new 30-year loan, you’ll only receive a mortgage interest deduction for 15 more years.

Prior to tax reform, interest would have been deductible for the full term of the new mortgage. While refinancing to a new loan with the same term as an existing mortgage won’t necessarily extend a mortgage interest deduction in perpetuity, it can offer investors greater flexibility to maintain a low monthly payment with the option—but not the obligation—to pay down the mortgage more aggressively each month.

On the other hand, it also extends the length of time you will be paying interest on the loan, assuming you own the property that long. The average length of homeownership is increasing, but the current 13-year average is well short of the standard 30-year mortgage term.

How much can you save by refinancing your mortgage?

When you refinance, you’re getting a new loan. This means a new amortization schedule as explained above. Refinancing can provide significant cost-savings, but it is a trade-off. When you refinance, all else equal, more of your monthly payment will go to interest than principal compared to your existing loan, even though you have a lower overall payment. This means that when you go to sell your home later on, your mortgage balance will be higher than if you had not refinanced.

To illustrate how the relative benefits of refinancing can change depending on the factors listed above, consider the following hypothetical examples. Please note, these examples are to illustrate how different factors can impact the relative savings on a conceptual level. For simplicity, the impact of taxes is excluded from this analysis, which includes the mortgage interest deduction.

Refinancing a newer mortgage

| Current | Refinance | |

| Mortgage Start Date | 1-Jan-2017 | 1-Mar-2020 |

| Original Loan Amount | $500,000 | |

| Current Loan Balance | $470,867 | $470,867 |

| Loan Program | 30 Year Fixed | 30 Year Fixed |

| Rate | 4.00% | 3.00% |

| Principal & Interest | $2,387 | $1,985 |

Monthly payment reduction = ($402)

Annualized savings = ($4,823)

Assuming the homeowner plans to stay in the house for 10 more years before selling, here’s how their conceptual profit and loss statement could look comparing refinancing to sticking with an original mortgage. In the breakdown, the sunk costs of principal and interest (P&I) paid until the mortgage was refinanced are factored in and included under total P&I paid in both scenarios.

| Current | Refinance | Notes | |

| Estimated Sale Price | $800,000 | $800,000 | In 10 years |

| Mortgage Balance at Sale | $349,268 | $357,952 | |

| Total P&I Paid Until Sale | $379,545 | $336,028 | Includes P&I paid prior to refinancing and closing costs (1% of loan) |

| Growth of Refi Savings | $0 | $15,340 | Assumes annual savings are invested with a 6% annual return |

| Net Cash From Sale | $450,732 | $442,048 | = Sale price – mortgage balance |

| Effective Net Proceeds | $71,187 | $121,360 | = Sale price – mortgage balance – total P&I & closing costs + growth on savings |

| Total Refi Benefit | $50,173 |

Refinancing doesn’t significantly reduce the monthly payment, as the loan balance isn’t drastically reduced from the original principal, but it does offer big interest savings over the life of the loan.

Refinancing an older mortgage

Now assume the original mortgage was from 2007, not 2017. Again, the sunk costs of principal and interest (P&I) paid until the mortgage was refinanced are factored in and included under total P&I paid in both scenarios.

| Current | Refinance | |

| Mortgage Start Date | 1-Jan-2007 | 1-Mar-2020 |

| Original Loan Amount | $500,000 | |

| Current Loan Balance | $350,487 | $350,487 |

| Loan Program | 30 Year Fixed | 30 Year Fixed |

| Rate | 4.00% | 3.00% |

| Principal & Interest | $2,387 | $1,478 |

Monthly payment reduction = ($909)

Annualized savings = ($10,913)

| Current | Refinance | Notes | |

| Estimated Sale Price | $800,000 | $800,000 | In 10 years |

| Mortgage Balance at Sale | $169,204 | $266,440 | |

| Total P&I Paid Until Sale | $665,994 | $560,370 | Includes P&I paid prior to refinancing and closing costs (1% of loan) |

| Growth of Refi Savings | $0 | $34,712 | Assumes annual savings are invested with a 6% annual return |

| Net Cash From Sale | $630,796 | $533,560 | = Sale price – mortgage balance |

| Effective Net Proceeds | ($35,198) | $7,902 | = Sale price – mortgage balance – total P&I & closing costs + growth on savings |

| Total Refi Benefit | $43,100 |

Relative to the newer mortgage, the benefit of refinancing an older loan is smaller. Also note that the growth on the savings investment as a result of the refinance is nearly 80% of the total savings! Since much of the interest has already been paid at the time of the refinance, what homeowners do with the extra monthly cash flow (which is over twice the savings from the newer loan) can make all the difference.

It’s worth noting that the ‘effective net proceeds’ is negative on the existing mortgage scenario above. That doesn’t mean you actually lost money on your home in real terms, but it creates a baseline for comparison.

Will mortgage rates go lower?

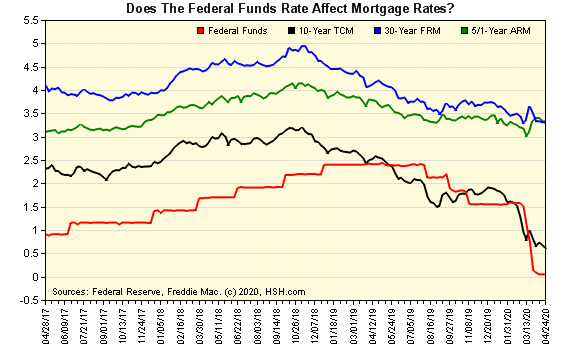

If you’re expecting another rate cut from the Federal Reserve, you might be wondering how that could impact mortgage rates. According to this chart from HSH.com, it’s clear that the Federal Funds rate does not move in lockstep with mortgage rates.

Why don’t rates move together? The Federal Funds rate is the Fed’s suggestion of what banks should charge each other to borrow money overnight to meet reserve requirements. It is the shortest of short term rates.

Mortgage rates on the other hand are influenced by several factors including consumer demand, the economy, inflation, and investor demand to name a few. Remember that mortgages must serve two different clients at the same time: borrowers, who want low rates, and investors (who buy the mortgage bonds) who want a risk-adjusted return. The required return will change relative to yields on other fixed income investments and with the broad-based economy and future expectations.

In short, like everything else in the financial markets, there’s no way to predict the future. It’s important to analyze the situation based on current information and in the context of your personal circumstances.

Is it always better to refinance?

No. Speak with your lender, CPA and financial advisor to understand the pros and cons of refinancing. But don’t wait too long – there’s no telling where rates will go from here.

Should you Pay off Your Mortgage Early?

Putting a Lump Sum Towards Your Mortgage Won’t Change Your Payment