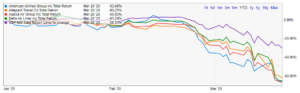

It is not uncommon for employees with stock options or equity based compensation to hold too much employer stock. Employees don’t often realize how much of their financial future is tied to their employer. Other times, individuals simply ignore the risks or just have no idea how concentrated they are. How much money you should have in your employer’s stock will depend on your net worth and risk tolerance, but in general, no more than 10% of your net worth should be invested in your employer’s stock. A concentrated stock position carries a number of documented risks, but there are ways you can diversify.

Risks of holding too much company stock

Regardless of the company, investing in single stocks is a risky strategy as you are exposed to a number of diversifiable risks. There are times where individuals knowingly take on this risk in “play” accounts, typically trading single stocks they have no affiliation to, with the understanding that it could become worthless. Having a play account can be very different from being dangerously overweighted in the stock of your own employer if you don’t understand the risks.

Taking into account your salary, benefits, and equity positions, ask yourself: would you invest this much in any other stock? Here are five good reasons why the answer should be “no”:

- Legislative: legal action against a company or changes that may impact core operations. Examples: For ride sharing services Uber and Lyft, longstanding legal battles challenging the independent contractor status of drivers could restrict operations; the Volkswagen emissions scandal caused its stock to nosedive and fines in the billions will certainly impact profitability.

- Regulatory: regulatory changes may place a significant burden on a specific industry and could even impact their ability to operate. Examples: For the healthcare industry, the passing of ICD-10 established a new national coding standard at tremendous cost to providers to update their systems; potential changes on Wall Street and in pharmaceutical pricing are still developing and highly linked to the new administration’s proposed policies.

- Company risk: unforeseen risks specific to a company due to their products/services, competitors, financials, and so on. Examples: Lumber Liquidators laminate flooring said to cause elevated risk of cancer causing stock prices to plummet; Wells Fargo’s unauthorized account opening scandal caused their stock to take a big hit and may have done irreparable damage in the minds of many consumers.

- Industry: industry risk is a type of risk that will affect all participants in an industry through a shared exposure to external factors. Examples: through the rise of the internet and free access to news, newspapers and printing companies have had to shrink amid falling subscribers; real estate and construction tend to prosper during times of low interest rates as mortgages become more affordable and it is cheaper to finance new projects.

- Employment risk: you’re already invested in your company by working there. Unless you have another source of income, the salary and benefits received through your employer are probably the key component of your financial health. Examples: between 2013 and 2016, Merck has had at least two large rounds of layoffs as a result of acquisitions and to reduce R&D expenses; employees receiving matching 401(k) contributions in the form of employer stock suffered great losses after the Enron scandal and more recently as a result of RadioShack’s collapse.

Individuals in M&A-heavy industries face an elevated risk

In addition to the types of risks previously discussed, employees working in industries that experience a lot of consolidation (e.g. technology, biotechnology, pharmaceuticals, and life sciences) should take additional precautions. There are a number of ways a company’s stock could be treated after an acquisition – assuming you already own it. Shares may be given a new valuation based on the terms of the deal and cashed out, or converted to shares of the new company’s stock, or left unchanged.

The outcome for unvested options or awards is a different story altogether. The acquiring company may transfer unvested equity positions over with the employee, convert it to a different type of equity compensation, cash out unvested positions, or perhaps just cancel them. Until liquidated, it is always somewhat risky to rely on proceeds from equity compensation, whether vested or not.

How much of your employers’ stock are you holding?

Determining how much stock you’re holding isn’t always as easy as it sounds. Depending on your answers to the following questions, you may need to diversify:

- Is equity compensation a significant part of your compensation package?

- After exercising stock options or becoming vested in restricted stock unit (RSU) awards, do you have a plan to liquidate the shares and use the proceeds to diversify?

- Are your matching contributions in your company’s retirement plan made in shares of stock? If so, do you sell the shares as soon as you’re able to diversify into other assets?

- Do you purchase shares of your company’s stock in the open market for your individual account?

- Do you participate in an employee stock purchase plan? How much of your salary do you contribute? Is your participation in conjunction with other forms of equity ownership?

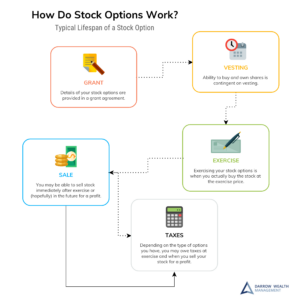

Ways to diversify out of your employer’s stock

Diversifying out of a concentrated stock position may have financial and tax implications, so work with your financial advisor and tax professional to develop a financial plan. Diversifying will involve a plan to liquidate all or a portion of the stock you already own as well as revisiting your current contributions and strategy to avoid this situation in the future. Exactly how you are concentrated will dictate what course of action is appropriate.