Like any investment account, rebalancing your 401(k) or 403(b) retirement plan is an important part of a successful strategy. An asset allocation is the percentage of your account that you distribute between different asset classes, like stocks and bonds. Without periodic rebalancing, your investment mix shifts and no longer aligns with the original allocation. This usually means you’re investing more aggressively or conservatively than you want. Rebalancing your 401(k) or 403(b) is just as important as setting your initial asset allocation to align with your risk tolerance.

How often should you rebalance your 401(k) or 403(b)?

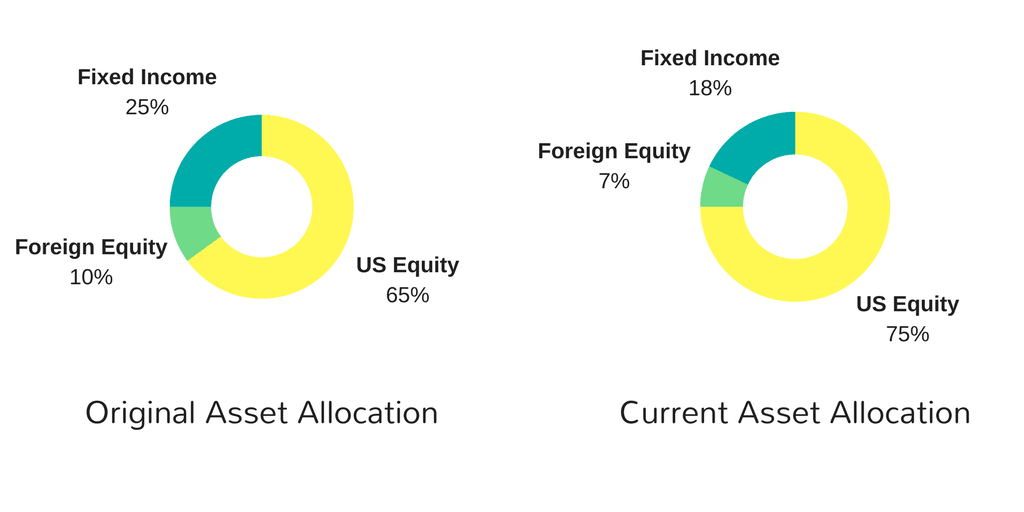

Rebalancing your portfolio is not something you need to do frequently. Generally, once or twice a year may be enough. The rebalancing process will require you to compare your original asset allocation to your current portfolio. If the holdings vary more than a maximum threshold of your choosing, then it may be time to rebalance.

For example, if you have a 5% threshold for changes to your target allocation, which includes 65% US equity, you would rebalance during your yearly review if your US equity position was outside the 60% – 70% band.

When the stock market is volatile rebalancing is challenging. Carefully weigh the pros and cons before proceeding.

Why rebalance your account?

Why rebalance your account?

As illustrated in the example, the current asset allocation does not match the original. In the example, the US equity portion of the portfolio has grown at a much higher rate than the fixed income and foreign equity holdings. This creates an investment mix that is more heavily weighted in equities.

It may seem counterintuitive to sell an investment that has been outperforming, but remember: past performance does not indicate future results. During a market correction, the unbalanced portfolio would be exposed to much more risk than an investor may reasonably expect.

To fix this, determine which equities to sell and reinvest the proceeds in by buying more bonds to restore the original weights of each asset class.

Don’t rebalance to a flawed asset allocation

As you may realize, there are some pitfalls to self-managing your portfolio. When the market goes down is perhaps the most common point investors decide to enlist the help of a professional. Creating a diversified portfolio that is aligned with your risk tolerance – and stays that way – is a complex and ongoing process. Many busy professionals don’t have the time to dedicate to self-education or the interest.

Before you rebalance your portfolio, objectively try to assess your comfort and skill in investment management. Your 401(k) might be your largest asset (aside from a home). If you’re not confident your original asset allocation is the best available, it likely doesn’t make sense to rebalance back to this potentially flawed allocation. If you only have a target-date retirement fund, it won’t require rebalancing. But that doesn’t mean an age-based investment is the best choice. Consider working with a financial advisor to ensure you’re making the most of your retirement savings.

Also Read:

Why rebalance your account?

Why rebalance your account?