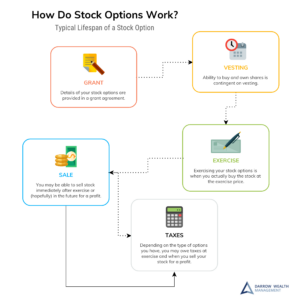

Updated for 2022. Restricted stock units are equity grants from your employer. When granted, the shares have no tax or income implications as they are still considered “unearned.” To earn the shares, employees must meet vesting requirements set forth by the employer. Many public companies will require time-based vesting for restricted stock units. But employers could also include other performance-related requirements, like reaching a target stock price. Private companies typically have a time-based vesting requirement in conjunction with an event-based requirement, such as an IPO, funding, or an acquisition for liquidity. To maximize the value of your RSUs, learn more about the tax treatment and how to diversify your equity at vesting.

When your RSUs vest, they are no longer considered restricted stock units; rather, you become a common stock shareholder in the company. The value of your equity grant will be determined by the current market value on the vesting date.

Tax treatment of restricted stock units

When vesting occurs for U.S. employees, the value of the stock grant is considered ordinary income for tax purposes. Ordinary W-2 income is subject to federal, state, and local taxes in addition to Medicare and Social Security. Social Security taxes only apply to wages up to $147,000 in 2022.

Many employers will automatically withhold a portion of income to cover some of the tax due. But some additional tax planning may be required, as the amount may not be sufficient depending on your situation. Consider consulting a CPA or other tax professional to determine whether a quarterly tax payment is required to avoid underfunding your tax liability.

Related: Restricted Stock Units vs Restricted Stock

Diversifying out of a concentrated stock position

Diversifying out of a concentrated stock position

Over-concentrating in a company’s stock is a common pitfall for those with equity-based compensation. RSUs are a component of your overall compensation package; but until the awards vest and the stock sold, you still run the risk that the proceeds are less than you expected – or perhaps worth nothing at all.

Individuals are often hesitant to let go of their company stock and diversify the proceeds into other investments. Having faith in your employer is a good thing – but having all your eggs in one basket typically is not. If you’re holding onto your equity in hopes of a large windfall, make sure you’re also comfortable with the possibility of losing your on-paper profits too. Financial markets can be volatile. The news of a merger, acquisition, and shifts in legislation and commodity prices can have a dramatic impact on stock prices, sometimes overnight.

Having a financial plan for your restricted stock units

Having a plan in place to manage restricted stock units can help by systematically diversifying your awards upon vesting. Much like the “set it and forget it” approach to saving, taking some of the thought out of what to do with vested RSUs can help avoid an inclination to hold onto too much company stock.

Financial planning for equity compensation is also important for tax purposes. When RSUs vest they are included in your W-2 as ordinary income. You’ll need to ensure your withholding is accurate and that you have the cash to pay the tax due. This may mean selling a portion of stock.

Depending on your outlook for the firm and overall situation, you may decide to hold onto the stock for over a year for more favorable long-term capital gains tax treatment.

Rather than waiting for the stock price to climb, consider taking control of your equity compensation and putting the proceeds to work for you and your goals. If you’re having a hard time “letting go” of a portion of your positions, consider your outside approach to investing. Would you invest 25 percent of your net worth in another company’s stock? Ten percent? Even with a favorable outlook on a firm’s financials, what is your comfort level for this type of concentration? The same risk tolerance should apply to the equity positions at your company.