Revocable or living trusts play an important role in many estate plans. Married couples utilizing trusts in their estate plan need to consider if it’s best to set up joint or separate living trusts. There are different tradeoffs which may make either a joint or separate trust a better option. Since state-specific laws play a big role in the decision as well as your financial situation and goals, it may be best for you and your attorney to start there before deciding on a trust vehicle.

Important disclosure: The material in this article is intended to provide generalized information only as to some of the financial planning considerations of joint or separate trusts. It should not be misconstrued as the rendering of personalized legal or tax advice. We strongly recommend you consult an estate planning attorney in your state to discuss your personal situation and estate planning needs. Darrow Wealth Management offers Private Wealth and Asset Management to individuals and families. We do not provide legal or tax advice.

What is a revocable living trust?

What is a revocable living trust?

A revocable trust (also called a living trust) is a trust you ‘fund’ during your lifetime and becomes irrevocable at your death. Funding a trust means retitling assets in the name of your trust.

Unless you fund the trust, it doesn’t really serve a purpose. During your life, you can add, use, or remove assets in the trust as you would normally. Also, there are no changes to the tax treatment of these assets.

Joint vs. separate revocable living trusts for married couples

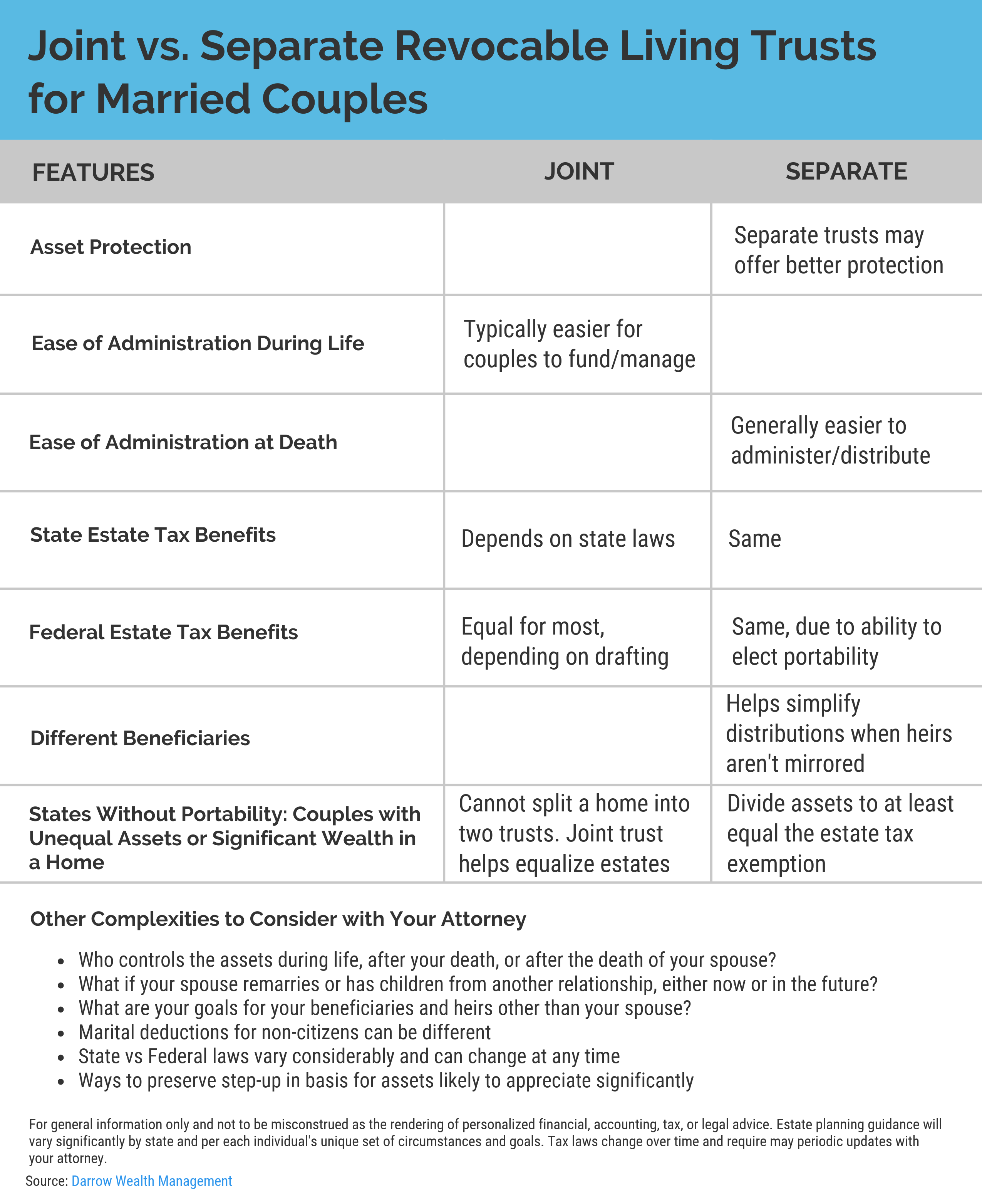

For some families, choosing a joint or individual living trust is a matter of preference or convenience. In other situations, one route could offer significant benefits over the other. Discuss the pros and cons with a trusts and estates attorney in your state to understand the implications. While not an exhaustive comparison, these are several considerations when choosing between joint or separate revocable living trusts.

Asset protection

In some cases, and depending on state law, separate trusts may offer better protection from creditors than a joint revocable trust. The type of asset also plays a role in the level of asset protection. Recall that revocable trusts can be accessed at any time. So it isn’t a tool for those with a primary focus on protection from legal claims.

Ease of administration

Joint trust

For many couples, a joint living trust is easier to fund and maintain during their life. They don’t need to think about equalizing the value of their respective trusts as everything goes into the ‘same pot.’ Both spouses are typically co-trustees of the trust. A joint trust also alleviates the concern that an asset (typically a home) is only owned by the trust of one spouse.

If both spouses want the surviving spouse to have full control over the assets in the trust and they both have the same ultimate beneficiaries of the residual estate, a joint trust may be the most straightforward to accomplish those goals. A joint trust can also be split at the death of the first spouse, allowing for the same general effect of a separate trust.

Separate trusts

For couples with equal incomes and assets, mostly separate finances, prenuptial agreement or second marriage, it may be more straightforward to maintain different trusts. Separate trusts can be set up so both spouses are co-trustees on each trust, or just one. If one spouse has kids from a previous marriage and would like to leave them an inheritance either at their death or the death of their surviving spouse, different revocable trusts keeps the distribution of your assets transparent and controllable.

Should I Put My House in a Living Trust?

Do I Need a Trust If I Have a Will?

Estate tax benefits

At the state level

In states with an estate tax not tethered to federal law, using either a joint or separate trust can be advantageous depending on the situation. The example assumes no additional tax planning was done with a joint trust to preserve the exemption.

Here’s a simplified example of how separate trusts can help preserve estate tax benefits:

Pramilla and Andy are a married couple in Massachusetts. It’s 2024 and the estate tax exemption is $2M. The couple has $6M in assets, $3M of which are in Pramilla’s living trust, with Andy’s trust owning the rest. If Pramilla dies in 2024, her marital trust is funded first (also called bypass or credit shelter trust) up to the $2M limit with the remaining $1M flowing to a family trust.

Andy could have access (to some degree) to both trusts for his life. If Andy dies later in 2024, the marital trust could pass to their children outside of Andy’s estate. Assuming no change in valuation, Andy’s gross estate would be worth $4M at his death. Due to changes in Massachusetts tax law in 2023, $2M of his estate wouldn’t be subject to the estate tax, but the remaining $2M would.

Had the couple not engaged in any estate tax planning at all, Andy’s estate would be worth $6M at his death, with $4M subject to estate tax.

The above is a simplified example of the benefits of using trusts for estate tax planning. Speak with an attorney to discuss your situation.

Note that you don’t necessarily need separate trusts to preserve a state estate tax exemption, it’s just often administratively easier if the assets are already separate before death. So depending on how the estate plan is written, it may still be possible to utilize a marital trust for a portion of the assets after the first spouse dies.

At the federal level

Federal estate tax legislation allows the portability of the $13.61M per person exemption (2024) between spouses. Before, credit shelter trusts could help ensure married couples could utilize the full credit. Thanks to portability, this strategy is no longer necessary for many citizens. To elect portability, families of the decedent need to file a federal estate tax return within 9 months of their death, or request an extension.

The change in legislation is a perfect example of why it’s so important to keep your estate plan current. Laws change; if someone dies with an old estate plan, they’ll likely wind up paying a lot more in attorney fees. What’s worse, after administration costs, the result may end up looking nothing like the original intention.

Attorneys Share Real Estate Planning Nightmares

Couples with different beneficiaries

As is particularly common for second marriages, not all couples share the same legacy goals. If spouses have differing views on who receives what, separate trusts help ensure each person’s assets pass according to their wishes. It also simplifies the asset distribution process after death, meaning beneficiaries could receive their share faster. Quicker often means less expensive as far as estate administration goes. So, this could also mean there’s more left for your heirs.

Important notes and final thoughts

Estate planning is a complex field that requires highly personalized planning. Laws change periodically and there are many different caveats and circumstances that could occur. Therefore, the support of a qualified estate planning attorney who practices in your state is essential.

Other complexities when considering joint vs separate trusts for married couples

Retirement assets

Retirement assets cannot be titled in the name of a trust. Accounts will can pass directly to heirs though beneficiary designations. Though it’s possible to name a trust as a beneficiary, it’s not usually the best option due to required minimum distribution (RMD) rules. Regardless, retirement assets are part of your gross estate. Note: starting in 2020, under the Secure Act, beneficiaries who inherit a retirement account from a non-spouse (e.g. parent or relative) must take the funds in 10 years or less.

Life insurance

Similar to retirement assets, life insurance passes by beneficiary designation. Proceeds will be included in your gross estate without an Irrevocable Life Insurance Trust. ILITs are a whole other topic, though. There are various pros and cons of naming a revocable trust as the beneficiary.

Step up in basis

When someone dies, certain assets like a taxable brokerage account or a home can be eligible for a step-up in basis to the fair market value as of the date of death. Depending on how your estate plan is set up, assets can get a step-up when the first spouse dies, and another when the surviving spouse dies. However, that can also mean owing estate tax on the assets eligible for the second step-up.

A credit shelter trust only receives the first step up, but bypasses estate taxation. Therefore, consider the current and future value of your assets. Specifically, which assets are likely to appreciate and the most appropriate vehicle to achieve your legacy goals though the estate planning process.

At Darrow Wealth Management, we work with families and often act as the coordinator with their legal and tax team to help ensure their wealth is managed at the highest level – even through generations. As an independent registered investment advisor, fiduciary, and second generation family business, we take the time to really get to know our clients and their loved ones to help provide continuity and support of their financial life as it evolves over time.

The material in this article is for general information only as to some of the financial planning considerations of joint or separate trusts. This article should not be misconstrued as the rendering of personalized legal or tax advice. We strongly recommend consulting an estate planning attorney in your state to discuss your personal situation.

Last reviewed January 2024

What is a revocable living trust?

What is a revocable living trust?