How aggressively you should be invested depends on more than just your risk tolerance. Some investors are much more emotionally risk averse than their goals will allow for. The question then becomes: can you handle the psychological aspect of being invested in the market in an effort to reach your life goals? The response is often a swift “yes”; of course the idea of early retirement will trump a few nail-biting days on Wall Street. But the unfortunate reality is often quite different. Truly risk-averse investors will panic and sell when the market dips below their engrained comfort zone, which often creates a scenario far worse than delaying retirement a couple of years or selecting a more conservative asset allocation.

Start with your goals

When considering how much risk you should take, start by detailing your life and income goals. For many individuals, this list is rather expansive: home purchase(s), education planning, travel, early retirement with substantial income, and so on. Be sure to include target dates and an estimate of how much you’ll need to fund each goal.

Understand your risk tolerance

Generally, investors won’t want to take on any more risk that is required to meet financial objectives. Consider putting potential portfolio gains and losses in dollar terms to help ensure you’re truly comfortable with that level of market exposure. When discussing a client’s investment objective, we use tools to help investor’s better understand the potential variability in performance.

Bring it back to your goals

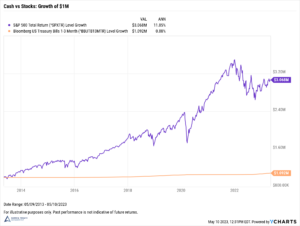

Setting up your asset allocation to match your risk tolerance is often a great first step, but in no way does it mean you’re on track to meet your goals. Your goals may require you to invest more aggressively than you would ideally prefer to, or sometimes, you’re willing to take on more risk than is required to achieve your objectives. Bridging the gap isn’t often achieved solely by changing your asset allocation, though. The primary reason individuals are off-track to meet their financial objectives is because they aren’t saving and investing enough.

Putting it all together to develop a plan

When we develop a comprehensive financial model for our clients, we combine all the pieces of their financial and life situation to create one cohesive view. Using income, fixed expenses and other discretionary spending data, we are able to project clients’ cash flows. Much of financial planning is driven by cash flows: is what’s left each month enough to achieve your goals if invested? If not, is it because your income is insufficient to reach your goals or are lifestyle expenses getting in the way?

Modeling allows us to test various what-if scenarios, which is instrumental to bridging the gap. For example, instead of retiring at age 65, what if we pushed it to age 68? Or reduced your travel budget from $35,000 to $25,000 annually? Goals later in life don’t always have to change either. Simply ramping up monthly savings can be enough in some situations.

In financial modeling, time isn’t always on your side. Those getting a late start investing and planning for their future or on the cusp of retirement don’t always have many options outside of working longer. On the other hand, starting early can really accelerate the accumulation of wealth for certain individuals. Although everyone’s financial needs and life goals are different, individuals who achieve their objectives often follow a similar path to success: they have a plan and followed it, diligently saving and investing over the long-term.