How much are your benefits worth? What programs should you participate in? Unfortunately, individuals don’t always know they can or should participate and sometimes the complex nature of benefit plans can lead to costly mistakes. To help ensure you’re taking advantage of the most significant financial resources your employer offers, familiarize yourself with your employee benefit package and work. Before making any changes, consider speaking with your financial advisor to discuss an approach that best fits your situation and needs.

Valuing an employee benefits package:

- Retirement Plans

- Deferred Compensation

- Stock Options, Restricted Stock Units and Equity-Based Compensation

- Insurance

- Flexible Spending Accounts and Health Savings Accounts

- Other Benefits

Employer-Sponsored Retirement Plans

401(k) and 403(b) Plans

Having access to a 401(k) or 403(b) retirement plan is a key benefit. Unfortunately, when many individuals begin a new job, setting up their new retirement plan is just one of many other administrative burdens. If you didn’t have a chance to properly investigate your investment options and consider your annual contributions, it is absolutely in your best interest to revisit your selections.

Maximizing the value of a 401(k) plan:

- How much should you contribute? In most situations, maxing out a retirement plan should be the goal. Although sometimes it isn’t a good idea to contribute the maximum about to a 401(k), most high-income individuals need to save above IRS limits to maintain their lifestyle in retirement.

- Is there an employer match? If your work offers matching contributions or profit-sharing, the value of a retirement plan goes way up. Assuming you stay long enough to vest, it’s free money. To help ensure you’re not leaving money on the table, consider how, and when, you’re contributing.

- Should you use a Roth 401(k) if offered? Some 401(k) plans offer a Roth component. This allows participants a way to diversify their retirement savings with after-tax contributions, which can then grow tax-free if certain conditions are met. A Roth 401(k) could be advantageous while tax rates are low (currently scheduled to sunset in 2025); however, unless it’s part of an ongoing tax diversification strategy, it may not be worth it.

- Should you move funds from an old retirement plan to your new 401(k) or 403(b)? Although your new retirement plan may permit rollovers, it may not be advantageous to do so, particularly if you have a sizable account balance. Retirement plans at work limit the investment options available, leaving some employees with high-cost or mediocre funds to choose from. There are also administration expenses associated with offering a retirement plan for employees. It is up to the employer to decide whether they will pay the cost or pass it onto the employees via a reduction of plan participant assets. Consider the pros and cons before rolling an old 401(k) or 403(b) to an IRA .

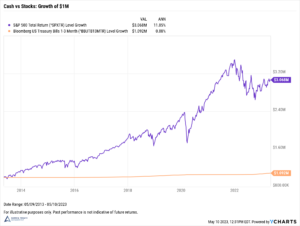

Workplace retirement plans allow investors to save the most for retirement, so the value of this benefit is substantial.

Deferred Compensation Plans

Nonqualified deferred compensation plans may be offered to high-earning individuals or executives as a way to defer additional income before tax. Unlike qualified retirement plans (e.g. a 401(k)), there is no IRC (internal revenue code) limit on contributions to a deferred compensation plan, though the plan may have its own rules.

If you have the choice of participating in a deferred compensation plan or supplemental executive retirement plan (SERP), do your homework before making a decision, as the terms of these plans can get quite complex. Individuals who already have a high concentration in tax-deferred retirement assets (e.g. traditional IRA, 401(k), 403(b), pension plan, etc.) may be better off diversifying in taxable or tax-free accounts, such as a brokerage account, Roth 401(k), or doing a Roth IRA conversion.

A nonqualified deferred compensation plan (NQDC) allows executives to defer income until a later date, therefore avoiding paying income tax until the money is paid out. While the cash is in “deferral mode,” you can select from a plan-specific menu of investment choices to capitalize on tax-deferred growth. Sounds a lot like a 401(k) so far – but here’s where they diverge. A deferred compensation plan is much more restrictive than a 401(k) plan. There are specific rules about the timing and nature of your future withdrawals, and most significantly, the funds are not secured from your or your company’s creditors in bankruptcy.

If participating makes sense in your situation, having access to a deferred compensation plan can be quite valuable. But the risks don’t always outweigh the rewards. This article has more on the pros and cons of deferred compensation plans.

Stock Options, Restricted Stock Units and Equity-Based Compensation

If your company offers incentive stock options, nonqualified stock options, restricted stock units, an employee stock purchase plan, or other forms of equity, it is important to understand what these benefits mean. Employer stock may be a significant part of your net worth or compensation, but paper-profits won’t help you reach your goals. A windfall from selling company stock is a great way to fast-track your goals, but you’ll need to plan in advance.

The risk, and reward, can be especially pronounced for employees at private companies as stock options or awards are generally illiquid. Just like the rest of your investments, the best approach to managing equity compensation is usually a balanced one.

Ways to maximize the benefits of owning company stock

- Don’t be afraid to take profits. When the stock is soaring, it seems like it can only go higher. It’s only when it plummets from a bad earnings report, shifting consumer sentiment, or one of a million other reasons that investors wish they could turn back the clock. Systematically liquidating to diversify can help smooth out stock price volatility and turn paper-profits into real ones. Holding too much company stock increases the innate financial risk on individuals and families if the employer’s fortunes suddenly fade. Consider working with a financial advisor and CPA to avoid making costly mistakes.

- Ask your advisors. Before exercising your options, be sure to understand the tax consequences and what action may be required on your part to avoid underpayment penalties or triggering the alternative minimum tax. Advance planning is also helpful for event-driven situations. What happens to your shares if you leave your job? All exits aren’t considered equal – whether you retire, are laid off, or quit may impact how your equity compensation is handled. Also consider ownership changes if your company is bought out by another firm or ceases to do business as a private company and files for an initial public offering (IPO).

- Taking advantage of a windfall. There’s always a chance of a sizable cash windfall through a liquidity event at the company or a sale of your shares. Consider how best to use the proceeds and allocate the cash when saving for multiple goals. Windfalls don’t come often, so take advantage of the opportunity through proper planning.

The value of having stock options or awarded shares at your company can be huge…but only with proper planning. To maximize the benefit of stock options or awards, you’ll need to have an integrated strategy that can help you diversify your investments, while taking into account the tax implications and other financial planning considerations.

Life and Disability Insurance

Life

It is common for companies to offer term life and disability insurance as part of their benefits package. Employers may pay for all or a portion of your coverage, but even when employees are responsible for premium payments, the rates may be more competitive through work than going directly to the insurance company. However, there are some clear advantages of getting a life insurance policy outside of the job.

When individuals decide to leave their employer they typically have two choices for their work-sponsored life insurance policy: let the policy lapse and purchase private insurance (if necessary) or continue the policy as an individual (often at much higher rates). For employees who have a substantial life insurance policy through their employer, it may be a lose-lose situation, particularly if you are older or have health problems, as you may not qualify for a new life insurance policy, at work or otherwise.

If you still need life insurance and are concerned about your ability to obtain a new policy, consider whether to keep your current policy in force. There’s a common misconception that everyone needs life insurance forever.

While getting life insurance at work is a quick and easy way to get coverage, it might not be the most economical in the long-term. Consider the pros and cons of getting a private policy on your own.

Disability

Regardless of your age, it is prudent to obtain adequate short and long-term disability coverage for your situation. Although self-funding may be an option for some short-term disability situations, long-term disability coverage is essential. According to DisabilityCanHappen.org, the average long-term disability claim lasts 3 years, which is pretty frightening considering the average 20-year-old has a 1-in-4 chance of becoming disabled before they retire.

It is possible that you have disability insurance coverage at work, either automatically or by enrolling, and weren’t previously aware. Contact your HR department or review your employee benefit plan documents to learn more about what coverages are available to you.

Having disability insurance at work is very valuable. Often, premiums are paid after-tax or included in your taxable income so benefits can be mostly tax-free. It’s usually cost-prohibitive to get private disability insurance, but group policies at work are cheaper. During open enrollment, don’t skip this benefit!

Health Insurance, Flexible Spending Accounts and Health Savings Accounts

Even if your employer doesn’t help cover the cost of health insurance, it will almost assuredly be cheaper with group rates than if you bought it on your own. For many employees, health insurance is one of the biggest employee benefits. Dental and vision plans only increase the value of these benefits.

FSAs

Flexible spending accounts offer a tax-advantaged way to pay qualified medical and dependent care expenses. You can specify an amount (up to certain limitations) to be withheld pre-tax from your paycheck and added to the savings account, and when you incur qualifying expenses, submit the appropriate documentation for reimbursement. Traditionally a use-it-or-lose-it benefit, FSAs are growing more flexible with plan design and options to use your balance if you change jobs.

Is it worth the hassle to participate in an FSA? It might be, especially for high earners due to the tax savings. And don’t forget about the dependent care FSA. Review current IRA limits and learn more about FSAs.

HSAs

Health savings accounts have similar features to FSAs but offer a few key differences which make this type of benefit particularly advantageous for the right individual. HSAs also offer pre-tax reimbursement for qualified medical expenses, however, individuals must enroll in a high-deductible health plan (HDHP) to participate.

HDHPs must have a minimum annual deductible and maximum annual out-of-pocket expenses. Since employees shoulder a greater portion of their healthcare costs at the beginning of the plan year, HDHPs tend to benefit single, healthy, younger workers more. This article has more information on health savings accounts and flexible spending accounts including current limits.

Other Benefits

If you work for a big company, you may have access to benefits you hadn’t even thought of. Some less common benefits include adoption assistance, legal resources, unlimited vacation, discounted home or auto insurance, free child care on-site or at home, subscriptions, health and fitness subsidies, savings for purchases of tickets, entertainment, or consumer goods, paid leave for a sabbatical, discounted transportation and parking, and free meals.

If you’re not sure what programs are in place at your company, ask! After all, you can’t take advantage of a benefit if you don’t know what it is.