Timing is everything. Unfortunately, it likely isn’t possible to un-do a decision to retire if the market takes a dive shortly thereafter. We all know the financial markets can be volatile, and ups and downs are normal – even necessary to keep the risk/reward framework in check. While these fluctuations can be expected during a decades-long retirement, new retirees may not anticipate the possibility of a recession or some of the worst years in the market at the start of retirement. When this happens, it is highly likely that changes to a retirement plan or annual income expectations will be necessary to avoid prematurely depleting your financial resources. Thankfully, robust planning can help retirees survive a recession at the beginning of retirement.

What Happens If You Retire During A Recession?

What Happens If You Retire During A Recession?

Timing is everything, but you can’t always control it. Can you still retire if your planned retirement falls during a recession or severe market downturn? Perhaps you are forced into an early retirement or an economic downturn occurred just after you entered retirement. Either way, further planning will be required.

How to Prepare Your Finances for a Recession or Prolonged Market Downturn

Compounding: a quick recap

Essentially, compounding enables investors to earn a return on previously incurred investment returns. Over time, compounding mean invested dollars can work harder. The benefits of compounded growth are most evident over longer time horizons – typically 10 years or more.

Here’s a quick example of compounding in action:

Assume Sam opens an investment account at age 40 and contributes $40,000 per year for 10 years, then reduces the annual contribution to $20,000 for another 10 years. Assuming an annual return of 5%, by the end of 20 years, Sam’s account has grown to $1,124,634, through contributions of $600,000.

Now assume Alex, also age 40, opens an investment account and contributes $20,000 per year for 10 years with the same 5% annual return. After 10 years, Alex increases the annual contribution to $50,000 for the next 10 years. By the end of 20 years, Alex’s account has grown to $1,090,589, through contributions of $700,000. Despite investing $100,000 more than Sam, Alex’s account is still $34,046 smaller because of compounding.

For simplicity, these examples do not account for market volatility, fees, expenses, or taxes.

Impact of a Market Downturn at the Start of Retirement

After retiring, many individuals drastically reduce contributions to investment accounts and most will begin to draw down their invested assets. Although market volatility may have been a consideration during pre-retirement planning, the specific timing of down markets might not have been, which is called the sequence of returns risk. When planning for retirement, severity and timing of market volatility should be considered, as the timing of a downturn can be just as important as the severity of one.

Related: The U.S. is in a Bear Market. There Could be a Recession. But This Isn’t 2008.

Should You Go To Cash Until The Market Recovers Or Ride It Out?

For the following examples, we’ll assume the same set of assumptions:

- The initial portfolio value at year 1 of retirement is $1,000,000

- The retiree is withdrawing $50,000 annually, at the beginning of each year

- The retirement period is 25 years

- The investor will earn a 5% rate of return annually, except for the “worst years” indicated, when the rate of return is -8% annually

- Fees, expenses, or taxes are not included in the analysis

Impact on the ending value of the portfolio at year 25 when the market downturn occurs at different years:

| Trial # | Worst Year(s) | Ending Value (Year 25) |

| 1 | 1 | $482,382 |

| 2 | 1 & 2 | $153,361 |

| 3 | 10 | $631,385 |

| 4 | 10 & 11 | $425,822 |

| 5 | 10, 11 & 12 | $257,967 |

In trials 1 and 3, when there was only one year the retiree experienced an -8% return (obviously not a realistic assumption, but simplicity is critical for illustrative purposes), the investor’s ending portfolio value was nearly $150,000 greater if the event occurred at year 10 instead of year 1.

Trials 2 and 4, when there were two consecutive years of -8% returns, the portfolio value in trial 2 was nearly $275,000 lower, when the downturn took place at the onset of retirement.

In trial 5, the longest downturn, the final value of the portfolio was still over $100,000 greater than trial 2, when there were only two years of losses, but they occurred at the beginning of retirement.

The takeaway: You can’t control the financial markets, but you can control how prepared you are for a variety of different outcomes.

Analysis: How Market Volatility and Cash Flows Impact Your Account

Should You Keep Investing During a Recession?

Stress tests can help retirees survive a recession at the beginning of retirement

The S&P 500 may have an average annualized return of between 6%-9% between 1927 and 2018 (can vary depending on whether dividends are assumed to be reinvested, inflation, etc.), but there have only been a handful of years when the index commonly used as the barometer for the US stock market has actually produced an annual return within this range.

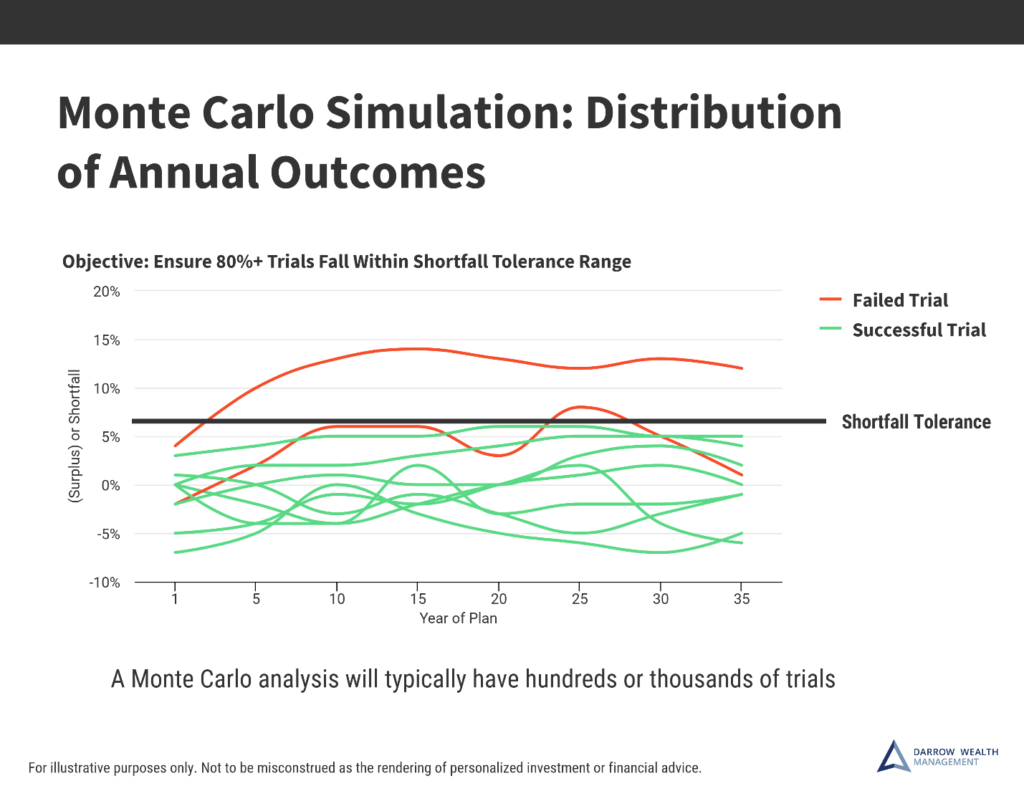

A Monte Carlo analysis can be used to identify the probability of certain outcomes to manage risk and develop prudent planning assumptions. In financial planning, one of the uses of a Monte Carlo simulation is to test the viability of a projected income stream in retirement under various market conditions. The results of the analysis can be very powerful.

Here’s an example of how we might use a stress testing simulation as part of a client’s retirement plan:

To help a couple assess the feasibility of their retirement goals, we develop a comprehensive financial model. The financial plan includes living expenses in retirement, projected Social Security benefits, taxes, life expectancy, inflation, and so forth. As each of their investment accounts are added to the plan, detailed return assumptions are also included based on the client’s investment objective, including the standard deviation of the average expected annual return.

In phase one of the planning, we start with a ‘straight line’ assumption of asset growth and depletion. Although more robust than many compounded investment growth calculators investors can find online, phase one of the analysis doesn’t account for the variability in investment returns – only that the average annual return will be achieved year over year.

When the probability of success is near 100% on the baseline investment return assumptions, we can move to the second phase of planning and utilize a Monte Carlo simulation.

For example, we may run 500 different trials with a ($10,000) deficit tolerance for retirement expense coverage. This assumes the client could bridge a ($10,000) gap one year, perhaps by cutting back or drawing on a cash account.

Using the return assumptions and standard deviation inputs in the plan, the model now accounts for market volatility and its impact on cash flows, producing a probability of success across all of the trials. When a surplus is generated or a deficit smaller than ($10,000), the trial is considered a success.

What’s the likelihood you won’t run out of money?

Overall, we generally strive to reach an 80% probability of success or better that a client can achieve their lifestyle goals in retirement without running out of money.

The results of a Monte Carlo simulation can be quite dramatic. It’s not unusual to have a baseline success rate of 100% but a probability of success in the 60% when accounting for market fluctuations. This is why a more robust approach to retirement planning is so critical. Comprehensive financial planning with a Monte Carlo simulation can be a great tool to help give investors piece of mind that their retirement strategy has been tested under all market conditions.

Related:

What Happens If You Retire During A Recession?

What Happens If You Retire During A Recession?