Whether you work for a company that is pre-IPO or has recently gone public, you may wonder what that means for your stock options or restricted stock units (RSUs). The truth is, there are many different things that can happen to stock options when a company IPOs. Here’s a summary of what can happen to stock options after a company goes public.

What happens to stock options in an IPO?

Employees may wonder what happens to their stock options when their company goes public. An IPO provides liquidity for the company. It’s also an exit strategy for founders/investors and a way for employees to sell stock too.

When a company goes public, individuals with stock options or shares typically experience few meaningful changes. For example, companies may change stock administration providers and implement new rules on trading to comply with SEC regulations, but an IPO wouldn’t trigger an automatic exercise or sale of stock options or shares.

Although not stock options, holders of double-trigger restricted stock units usually need an IPO to fully vest. In this case, an automatic sale of shares may take place to cover mandatory tax withholding.

If you already own stock in a private or pre-IPO company

Assuming you already exercised your stock options, the IPO is probably welcome news. However, keep in mind that there will be a lockup period after the IPO that will prevent insiders (such as employees) from selling their shares. Companies going public with a direct listing bypass the lockup period, meaning employees can sell their stock options right away if they choose. Companies going public via SPAC may have longer lockup periods.

A lockup period can range from 90 to 180 days. A stock price may also drop when the blackout period expires, as insiders may sell shares to get the cash. Lockups can vary: sometimes it’s a stated number of days, event based (such as reaching a target share price or an earnings release), multi-stage release, etc. Restrictions often also apply to former employees.

Bottom line: it’s a highly nuanced situation when a company goes public. Seriously consider working with an advisor who has extensive experience in stock option and IPO planning.

More on developing a strategy for your shares later in the article.

If you have unvested or vested unexercised options at a pre-IPO company

Publicly traded stocks listed on an exchange have a clear value, determined by the market each day. They are also typically very liquid. Most shares can be sold and redeemed for cash rather quickly.

Private companies work get a fair market value, but it may only be done once a year. Because of this, it’s less transparent to employees. The last 409a may be stale. Unlike public stocks, a private company will decide if/when/how they want to allow employees to liquidate their shares for cash.

Given these risks and tax treatment of incentive stock options (ISOs) and non-qualified stock options (NQSOs), many employees are hesitant to exercise in this environment.

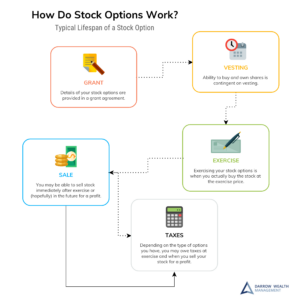

When to Exercise Stock Options

Unvested options

Unlike in the case of unvested options in a merger or acquisition, nothing will necessarily happen to your unvested options as a result of the IPO. The exception is that the IPO makes it easier to exercise and sell your shares. There is typically no change to your vesting schedule.

Once your shares vest (and after the lockup period) you’ll know the price you could buy (your strike price) and sell the stock for. This can help you determine if you want to exercise and sell or hold or simply wait. Again, there are tax consequences so it is important to work with your financial advisor and CPA first.

Vested options you haven’t exercised yet

If you have vested options that you haven’t exercised, perhaps because of liquidity issues, you’ll have choices to make. First need to look at your strike price relative to the internal valuation of the company. If the exercise price is above or equal to the fair market value (FMV) of the shares, it doesn’t make sense to exercise your options.

Selling Stock Options After An IPO

5 Stock Option Mistakes People Make During an IPO

What Happens to Stock Options if I Leave the Company?

Depending on what type of stock option you have (ISOs vs NQSOs) and how long you end up holding the shares for, exercising before the IPO could mean you pay less in taxes later. This could happen if the value of the shares when you exercise before the IPO is less than the value once the stock is publicly traded. The closer you are to an IPO the riskier this strategy is, though.

However, it is really important to keep in mind that stock options must be purchased in cash for employees of private companies. IPOs are notoriously volatile and stocks don’t always go up, and you may still be in a lockup. It may help you sleep at night to wait until the company goes public before exercising and selling your shares.

Video: What to do with stock options and restricted stock before an IPO

Restricted stock units in an IPO

Restricted stock units are different than stock options because they are awarded, not purchased. RSUs are becoming increasingly popular because they are easier to administer and simplify the process for employees also.

Unlike stock options, which can become underwater if the price you paid is more than the fair market value, RSUs will always have value as long as the company is solvent. They are awarded in terms of number of shares and the value of the shares is the market value when they are fully vested and released.

Restricted stock units are given a vesting schedule and upon vesting shares are typically delivered to the employee in the form of common stock. The employee will be taxed at ordinary income rates for the value of the award they received upon vesting. Vesting schedules for RSUs are usually time and event driven.

Many public companies will require time-based vesting but could also include other performance-related requirements, like reaching a target stock price. However, private companies often have a time-based vesting requirement in conjunction with an event-based requirement, such as an IPO, funding, or an acquisition for liquidity. When restricted stock units are awarded at private companies, they are typically double-trigger RSUs.

RSU-holders also have lock-up periods, though it’s common for employees to be able to sell some shares shortly after an IPO to align with the recognition of income and required tax withholding. The company will share the details and limitations of this type of early tax release program.

What to do with stock options after your employer goes public

If you work for a company while it goes public, it is probably a very exciting time. However, it is important that you remain as objective as possible about your employer and work to develop a plan to liquidate and diversify your equity when the time is right. How much money you should have in your employer’s stock will depend on your net worth and risk tolerance. But in general, no more than 10% of your net worth should be invested in company stock.

The risk is higher when you’re heavily concentrated in employer stock, as you already rely on the success of the business to pay your salary, benefits, etc. Consider: if you get a cash bonus, would you buy more company stock?

Taxes, liquidity, and cash needs

When you exercise ISOs, it’s not a taxable event, though you may owe tax if you trigger the AMT. But if you exercise non-qualified stock options, the spread is taxable as regular income. Any further gain or loss is a capital gain/loss depending on your holding period. You’ll also need to come up with the cash to buy the shares.

When you exercise and hold stock options, you may need another source of cash to pay the tax. Current employees with NSOs will need to satisfy the withholding requirements for current or former employees (22% or 37%), payroll tax, and possibly state tax. Employees have more options to pay tax after an IPO, like having the company withhold shares or sell a portion of the stock for taxes.

As you consider how best to proceed, be cautious when using your outside (and perhaps more diversified) assets and cash in an effort to hold onto your shares after exercise. Doing so often increases your risk and gives you much less flexibility to fund your other goals.

What Employees Should Do When Their Company Goes Pubic

Luckily, there are ways to diversify out of a concentrated stock position, and the IPO makes it easier. If you expect a large windfall, it may make sense to pull everything together in a financial plan as a big investment in one of your goals (down payment, college, retirement, and so on) may get you there a whole lot faster.

Financial advisor for stock options and sudden wealth

Darrow Wealth Management specializes in stock options and equity compensation. If your employer is going public, work with an advisor experienced with strategic stock option planning, tax implications, and strategies to best manage sudden wealth. You only get one shot at this.

Here are some of the ways we work to help executives, founders, and employees navigate an IPO:

- Exercise strategies

- Trading plan and execution

- Assist with identifying and tracking shares likely to qualify for the tax-free sale of qualified small business stock

- Decide on a strategy to best use the proceeds, including funding multiple goals and investment management services to help you diversify sudden wealth

- Incorporating the proceeds from a major liquidity event into your financial goals and projections

- 10b5-1 plan provisions

Schedule a call with an advisor

Nationally Recognized Wealth Advisor in Stock Compensation

Kristin McKenna CFP® is a nationally recognized specialist in employee stock options and equity compensation.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.

Darrow Wealth Management offers Private Wealth and Asset Management to individuals and families. This article is not personal financial, investment, tax or legal advice. Darrow Wealth Management does not provide tax or legal advice; for inquiries regarding your personal tax or employment situation, consult a CPA or employment attorney in your area.

Last reviewed February 2024