Ways to Invest After Maxing Out a 401(k)

Wondering what to do after maxing out your 401(k)? If you’re looking for ways to save outside of your retirement plan, most individuals have three options: a brokerage account, IRA, or Roth IRA. Investing after maxing out a 401(k) is wise, especially since your retirement accounts may not be enough to fully fund the lifestyle you want.

For individuals or families with a high income and significant capacity to save, a brokerage account is probably the best way to save after maxing out your 401(k).

3 ways to invest after maxing out your 401(k):

- A brokerage account

- Traditional IRA

- Roth IRA (subject to income limits)

Where should I save after maxing out my 401(k)? What to Do After Maxing Out Your 401(k)

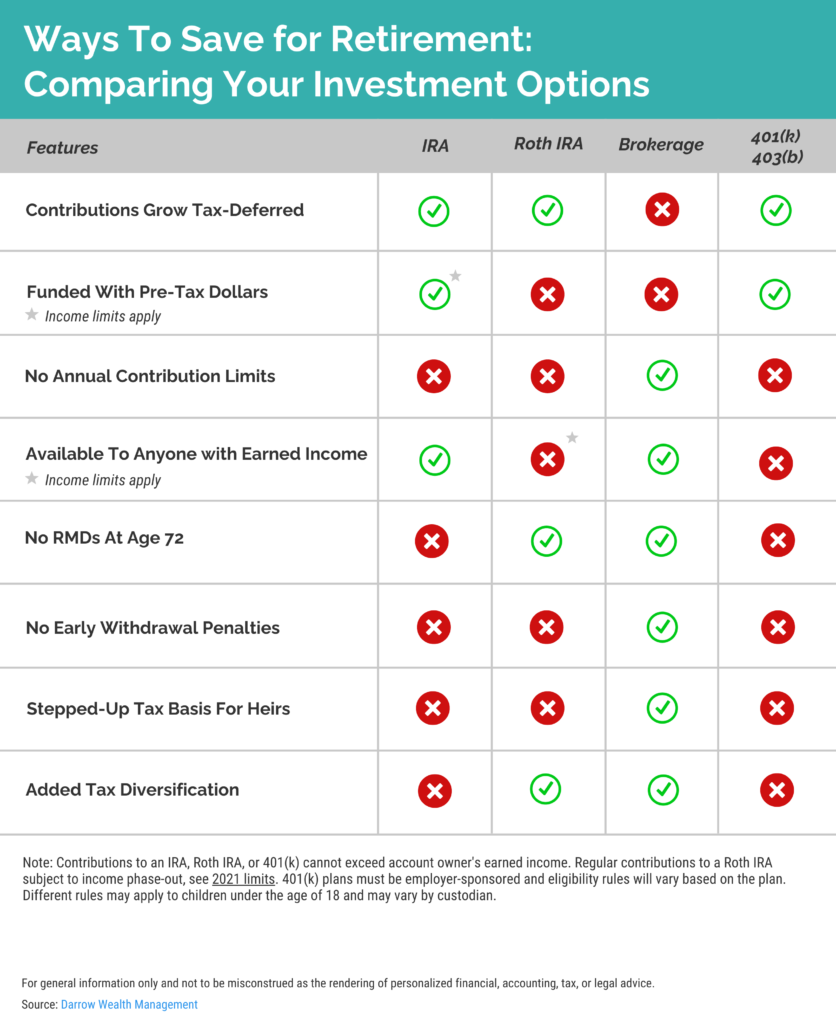

Comparing Investment Options: Brokerage Account vs. IRA vs. Roth IRA

Investing with a brokerage account after maxing out a 401(k)

A brokerage account is a popular type of investment account due to the flexibility it affords investors. With no income restrictions or funding limits, a taxable account provides the most options for investors. Further, unlike retirement accounts, assets in a brokerage account can be used for any purpose at any time without early withdrawal penalties.

Invest outside of retirement accounts

With a 401(k), IRA, or Roth IRA, there are limits as to when you can use the funds – and for what purpose – without incurring a penalty. A brokerage account is free from these restrictions. Individuals often use a brokerage account to save for medium to long-term goals such as college (to avoid over-funding a 529 plan), a new or second home, major asset purchase, or just because they have extra cash flow to put to work.

Retirement savings outside of a 401(k)

For high-income individuals, maxing out annual 401(k) contributions likely won’t be enough to maintain an equal lifestyle in retirement, especially if you wish to retire early. Retiring early is also even more difficult without taxable assets as you’ll need to bridge the gap before penalty-free distributions from 401(k)s or IRAs begin. A brokerage account can also help you pay for the cost of pre-Medicare health insurance.

How a brokerage account is taxed

You make contributions to a brokerage account with after-tax dollars, so there is no tax deduction. Dividends, interest, or capital gains distributions from mutual funds and ETFs received during the year are taxable annually. Taxes can be a factor even if you don’t sell funds and elect dividend reinvestment.

When you sell a fund in your account, there will usually be a capital gain or loss depending on your purchase price and cost basis which will be taxable in the current year. This infographic has more on how a brokerage account is taxed.

A brokerage account brings tax planning opportunities in retirement

If you only have assets in tax-deferred accounts, you may have fewer tax planning options in retirement. Tax-deductible contributions means distributions in retirement are taxable as regular income. If taxable or tax-free assets are available, you could consider other planning opportunities as your situation changes each year.

You could work with your financial advisor and CPA on an analysis to determine the optimal withdrawal strategy, perhaps blending withdrawals from different types of accounts or choosing tax-deferred assets in years where you’re in a lower marginal tax bracket.

The tax code is always subject to change and tax diversification provides added flexibility. Using different tax vehicles also helps reduce the risk that unfavorable changes to tax laws pertaining to one type of account will impact your whole financial plan.

Inheritance tax planning

The tax rules change when a beneficiary inherits a brokerage account. If your spouse or heirs inherit a taxable brokerage account, the assets can pass on a “stepped-up” cost basis, which increases ‘steps up’ their inherited cost basis in the asset to the value on the date of your death.

Here’s a simplified example: In 2009, Brooks purchased 500 shares of WXYZ ETF for $50/share. The ETF is currently trading at $200/share. If Brooks sold all 500 shares today, he’d have a long-term capital gain of $150/share or $75,000. Brooks is in the 20% tax bracket for long-term capital gains, so his tax due is $15,000 before the 3.8% Medicare surtax. Now assume Brooks dies today. His heirs have a stepped-up cost basis of $200/share. This means they could sell all the shares with no capital gain and no tax due.

Skip the required minimum distributions

Unlike Traditional IRAs, 401(k)s, 403(b), pension plans, etc., there are no required minimum distribution (RMD) rules on assets in a brokerage account. Retirees who don’t need the income can preserve wealth to pass onto heirs and avoid unnecessary tax consequences, and the reinvestment risk by staying invested.

The brokerage account is even more relevant following the death of the ‘Stretch IRA’

Under the Secure Act, which was passed in 2019, beneficiaries who inherit a retirement account from a non-spouse (e.g. a parent or relative) can no longer ‘stretch’ the distributions over their lifetime by taking RMDs. Instead, they will be forced to take the funds in 10 years. The change won’t impact anyone who inherited a retirement account during 2019 or years prior.

Given the step-up in cost basis and no RMDs for inherited brokerage accounts, this type of account may become even more popular in legacy planning.

Should you max out a 401(k) and traditional IRA?

Tax-deferred growth is so powerful due to compounded investment growth, but unless you’re only focused on ways to save for retirement, an IRA may not be the right choice due to early withdrawal penalties. There are some exceptions, but having flexibility is valuable.

Anyone can make contributions to a Traditional IRA up to the lesser of their earned income or $6,000 per year in 2021-2022 if under age 50. If 50+, you can save an additional $1,000. Whether you can make a tax deductible contribution depends on if you’re covered by a retirement plan at work, your income, and tax filing status. See 2021 limits or 2022 IRS limits to determine whether you’re eligible.

Though it’s possible to make an after-tax contribution to an IRA, there are several big drawbacks that make this strategy less advantageous. Investors sometimes doesn’t realize they’re responsible for tracking non-deductible contributions, not the IRS or a financial institution. Unless they can keep proper records over time, they could end up paying tax twice.

Should you always max out your 401(k)? Actually, no.

Making the most of an employer match by timing your 401(k) contributions

Contributing to a Roth IRA and a 401(k)

The primary feature of a Roth IRA is that provided a five-year holding period is met since your first contribution and you’re age 59 1/2 or older, withdrawals will be completely tax-free (though there are several penalty exceptions to the age and five-year holding period requirements and only the investment growth portion of the account is subject to taxes or penalties).

Otherwise, a Roth IRA shares features of both a brokerage account and an IRA. Contributions are made after-tax and there are no required minimum distributions in retirement like a brokerage account. Like an IRA, funds enjoy tax-deferred growth and early withdrawal penalties may apply before age 59 1/2.

Non-spouse beneficiaries of retirement accounts must take the money by the end of the 10th year after inheriting the account.

Income limitations¹ apply which preclude wealthier individuals from making regular contributions to a Roth IRA. Contribution limits decrease as taxpayers move through the ranges until they become disqualified. Earn too much? Consider a backdoor or mega backdoor Roth.

Choosing between a traditional IRA and Roth IRA

Traditional vs. Roth IRA considerations are worthwhile. Roth accounts are most advantageous when a taxpayer expects to be in a higher tax bracket in the future. This is why they’re willing to pay tax on their contributions today.

Also consider how long you’re likely to maintain the strategy based on your income and the phase-out limits for Roth contributions or deductible IRA additions. A one-year Roth contribution may not be enough to provide much benefit later on.

Traditional 401(k) vs Roth 401(k)

With either IRA, the relatively low annual contribution limits may require the implementation of more than one savings strategy. The annual IRA funding limits applies to any Roth and/or Traditional IRA contributions in aggregate. In 2021 -2022 the limit is the lesser of earned income or $6,000 per year if under age 50. Investors 50+ get an additional $1,000 catch-up contribution.

Saving helps combat lifestyle inflation

With any strategy you choose, consider your progress each year combatting lifestyle inflation. If your spending increases because your income goes up but your savings rate stays flat, that’s lifestyle inflation. High fixed costs make it harder to save outside of retirement plans. Simultaneously, the higher cost of living raises the bar for lifestyle expectations in retirement, requiring saving more aggressively to afford it.

Infographic: I Maxed Out My 401(k) Now What? What to Do After Maxing Out Your 401(k)

¹ The phase-out range for single filers in 2021 is between $125,000 – $140,000 and for married couples filing jointly $198,000 – $208,000. The income phase-out limits in 2022: single filers is between $129,000 – $144,000 and for married couples filing jointly $204,000 – $214,000.