The economy has been booming since the financial crisis but tough times are back. Broad economic conditions impact hiring or layoffs for many workers, but there are other ways individuals can experience sudden and unexpected job loss. No matter the reason, it’s important to be financially prepared for an unexpected job loss. Weathering a prolonged period of unemployment or even forced early retirement is especially hard without a plan.

Reasons for unexpected job loss:

Reasons for unexpected job loss:

- Global pandemic

- Economic conditions

- Layoffs

- Mergers or acquisitions

- Disability

- Your health or to care for a family member

- Technological improvements can cut jobs

- Outsourcing

- Early retirement offers or buyouts

- Company closure or bankruptcy

- Worker performance

- Loss of major client or revenue stream

- Shifting customer sentiment or regulations

There are so many ways individuals could potentially lose their job. It can be disconcerting, particularly because employees often lack control over why it happened. But you do have the ability to prepare for unforeseen events.

Heightened risk of job loss for individuals over age 50

A study from the Urban Institute tracked over 20,000 adults over age 51 between 1992 and 2016 to identify trends in employment. The findings were significant:

- Over 50% of full-time workers over age 50 experienced involuntary employer-related job separation with their long-term employer. This lead to prolonged unemployment or a reduction in earnings of 50% or more for at least two years.

- An additional ~25% of workers had to leave their job to take care of a sick family member, due to their own health-related issues, or other personal reasons.

- In all, roughly two-thirds (66%) of individuals over age 50 experienced involuntary job separations at some point.

- Employer-related involuntary separations were largely consistent across geographic regions, industries, education levels, and demographics.

- Only 10% of workers who suffered a sizable drop in earnings got back to pre-separation income levels when they found another job. For college graduates, this drops to 8%

How to prepare your finances for unexpected job loss, layoff, or expended unemployment at any age

Cash reserves and liquid assets

As a rule of thumb, individuals should generally keep between 3-6 months of fixed expenses in cash as an emergency fund. Dual-income households may be able to protect themselves with 3 months of cash. Unmarried individuals or single parents may want to consider the upper end of the range.

Professionals in job-insecure professions such as freelancers, contract workers, or M&A-heavy industries like biotech and life sciences, it can be advantageous to be conservative with cash needs.

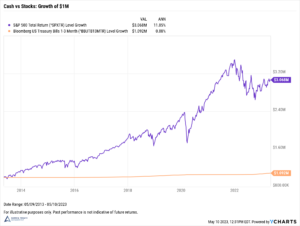

Saving money in a brokerage account and retirement accounts also provide safety in the event of a layoff or early retirement. Liquid assets provide flexibility and options for investors. Without enough cushion, a bad situation can quickly get worse.

Keep fixed expenses low relative to income

The easiest way to save money is to spend less money. Having high fixed expenses relative to your income not only makes saving more difficult while you’re working, but it also affords you the least flexibility if you’re unexpectedly no longer working.

Having a lot of flexibility in your monthly cash flow is another way to protect yourself should unplanned life events occur. If you have high fixed expenses, it can make it very hard to reduce spending when finances are strained. Typically, the largest fixed expenses for investors are homes (mortgage, property tax, maintenance, insurance) and car payments.

Don’t over-invest in company stock

How much money you should have in your employer’s stock will depend on your net worth and risk tolerance, but in general, no more than 10% of your net worth should be invested in your employer’s stock. A concentrated stock position carries a number of documented risks, but there are ways you can diversify.

Remember, if the reason for your sudden departure from the company has to do with the company’s souring financials, there’s a very good chance it will be reflected in the stock price. If you’re too heavily invested, the impact on your finances is magnified.

If you are laid off or offered a buyout, severance package, or early retirement offer

Whether you’ve already been laid off or if you’ve been given the option to part ways with the company, you’ll want to take stock of your finances right away. Work with your financial advisor to develop cash flow projections and review the offer from your employer. It may make financial sense to take the package, but it doesn’t always, which is why it’s critical to discuss the situation with your advisor before agreeing to anything with your employer.

A job transition can be difficult to navigate, particularly when unexpected. But with careful planning, and a little professional help, it’s possible to help ensure you find the best outcome for your situation.

Reasons for unexpected job loss:

Reasons for unexpected job loss: