Wealth Management Insights

Sign Up for Weekly Investing Insights

The Growing Appeal of Semi-Retirement

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in

Incentive Stock Options: Navigating AMT and AMT Credits

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.

6 Tax Strategies for Incentive Stock Options and AMT

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to

Using a Securities-Backed Line of Credit to Buy a Home

A securities-backed line of credit is like a home equity line of credit in many ways, though with this type of loan, the collateral is

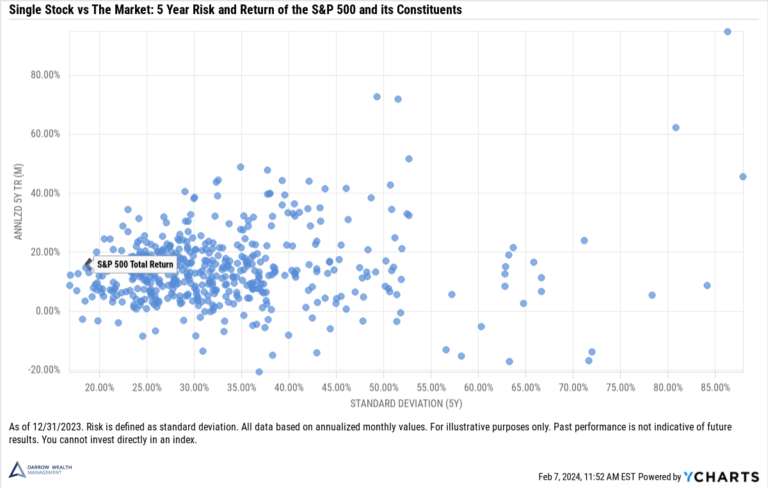

5 Ways to Manage a Concentrated Stock Position

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

2 Key Benefits of Living Trusts

With so many misconceptions around trusts, it’s easy to understand the confusion about the benefits of a revocable living trust. A living trust (also called

Make a Mark with These Financial Gift Ideas

It’s hard to come up with good gift ideas, especially over the holidays if you have a lot of people to shop for. Unfortunately, giving

Is Retirement a Good Time for Roth Conversions?

If you think retirement planning moves stop at retirement, think again. For high earners, converting an IRA to a Roth IRA while you’re still working

2024 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments. Also, the 2024 income tax brackets and long-term capital gains

Deciding What To Do When You Inherit A House

Of all the types of assets, real estate is usually the most emotional. It is, after all, difficult to make memories in a mutual fund

Starting a Home Renovation? Don’t Ignore These Key Insurance Risks

More homeowners have been renovating their homes instead of buying due to housing prices. While continuing to build equity in your home can be advantageous

Should You Exercise Stock Options During a Pre-IPO Window?

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they

Selling a Business? Brokers Share Tips on How to Maximize the Sale Price

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

Planning to Retire Early? Now You Need to Figure Out What to Do Next.

Who doesn’t love the sound of an early retirement? For many busy executives and business owners, slowing down and enjoying your financial success early in

Beneficiaries of Inherited IRAs Get More RMD Relief — For Now

A few years ago, if you inherited an IRA from a parent, the distribution rules were simple: you could stretch withdrawals over your life expectancy.

True Cost of Owning a Second Home

Owning a second home or vacation property can sound enticing. But it can also be very expensive, both in terms of time and money. There

Managing Sudden Wealth

There are many ways individuals become suddenly wealthy. Depending on the nature of the windfall, planning opportunities and considerations will vary. For example, the tax

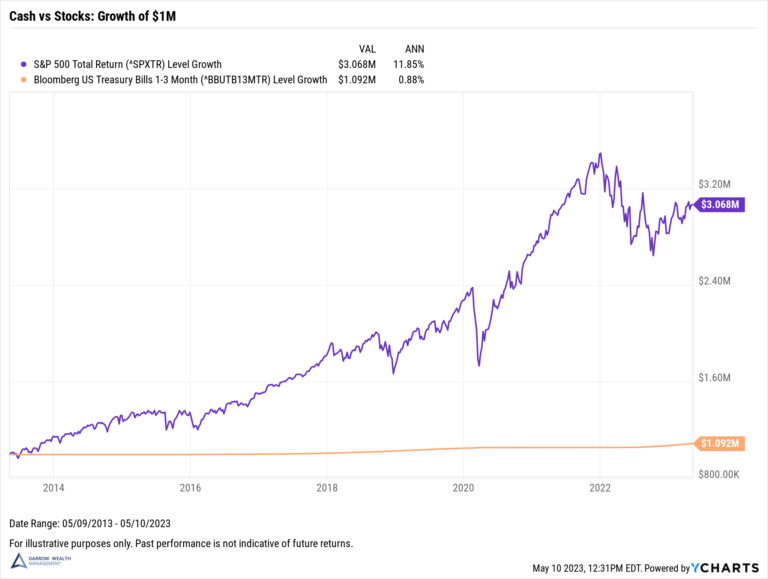

Hold Cash or Invest? History Shows Cash Isn’t King for Long

Should you hold cash or invest in the market? Attractive yields on savings and cash-like investments can make it tempting to hold cash instead of