What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too much company stock. Some C-level executives are required to hold a certain amount, but many employees voluntarily double-down by either holding vested stock or buying more through an employee stock purchase plan on a public exchange. A windfall from selling stock proceeds is a great way to build wealth, but you have to have a plan for the realistic possibility that it never materializes.

What can happen if you own too much of your company’s stock? Here are 3 real examples.

Don’t go for the BOOM if you can’t handle the BUST. It’s an important lesson for anyone with stock options, restricted stock, or other type of equity compensation at work.

In financial planning, the answer to most questions is usually it depends. But when the question is can I have too much company stock? the answer is decidedly YES; you can have too much employer stock – and many people do.

If it were any other stock, would you hold this much of it? Being optimistic about the future of the company you work for is a good thing but having blinders on is another. Sometimes individuals don’t even realize how concentrated they are.

The COVID-19 pandemic is the latest in a long line of examples illustrating how over-investing in company stock can quickly decimate on-paper wealth. For anyone with company stock wondering what’s the worst-case scenario if you own too much of your company’s stock, here are three real examples.

If You Own Too Much Stock In One Company, It’s a Good Time To Consider Diversifying

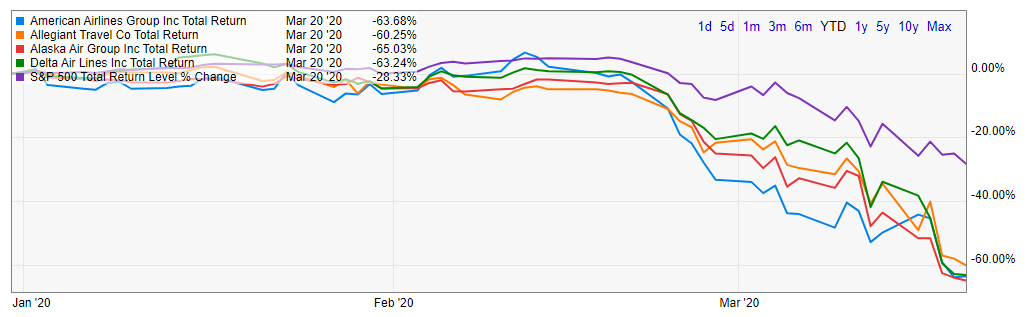

Total Returns – January 1st – March 20th 2020

Airlines

Source: YCharts

The major airlines have gotten crushed so far this year. American Airlines is down almost 64%. Some of the major carriers have recently announced no employee layoffs until September, but only if the government approves their $58 billion dollar bailout package.

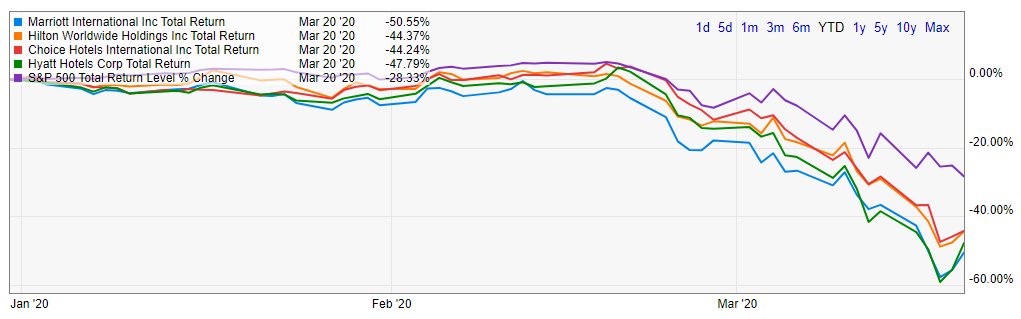

Hotels

Source: YCharts

Given the global shutdown, it’s no surprise major hotel chains have seen their stock prices essentially halved over the last few weeks. Employees have already started getting laid off and furloughed – and this is likely to accelerate in the coming weeks. Unexpected job loss – for particularly for individuals over 50 – can be devastating.

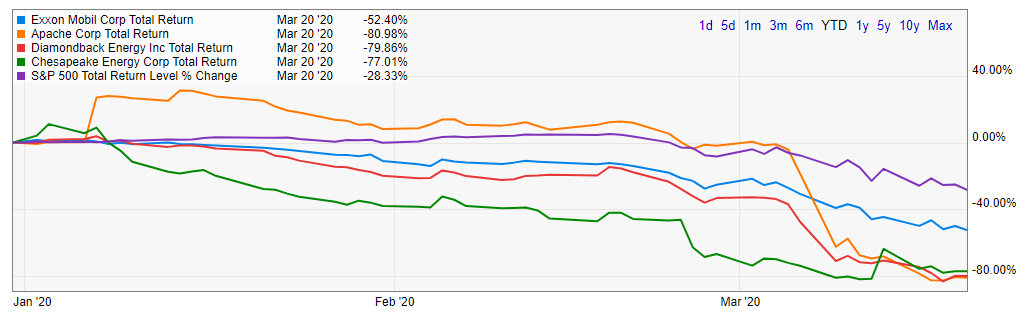

Oil and energy companies have also taken a beating for reasons unrelated to COVID-19

Source: YCharts

Apache Corp is down over 80% this year. Let that sink in. Layoffs are already being discussed. The nosedive in oil prices wasn’t virus-related either, although it certainly didn’t help. The downturn in the oil and energy field is a result of an ongoing disagreement between Russia and Saudi Arabia about how to set production levels to boost prices.

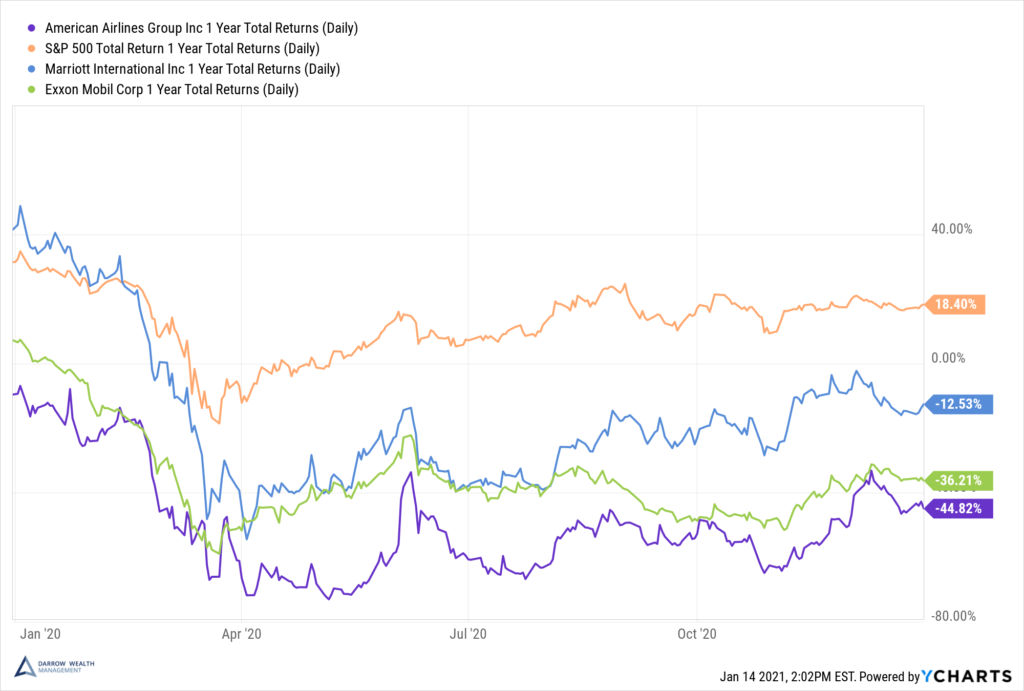

2020 total returns for select companies and the S&P 500

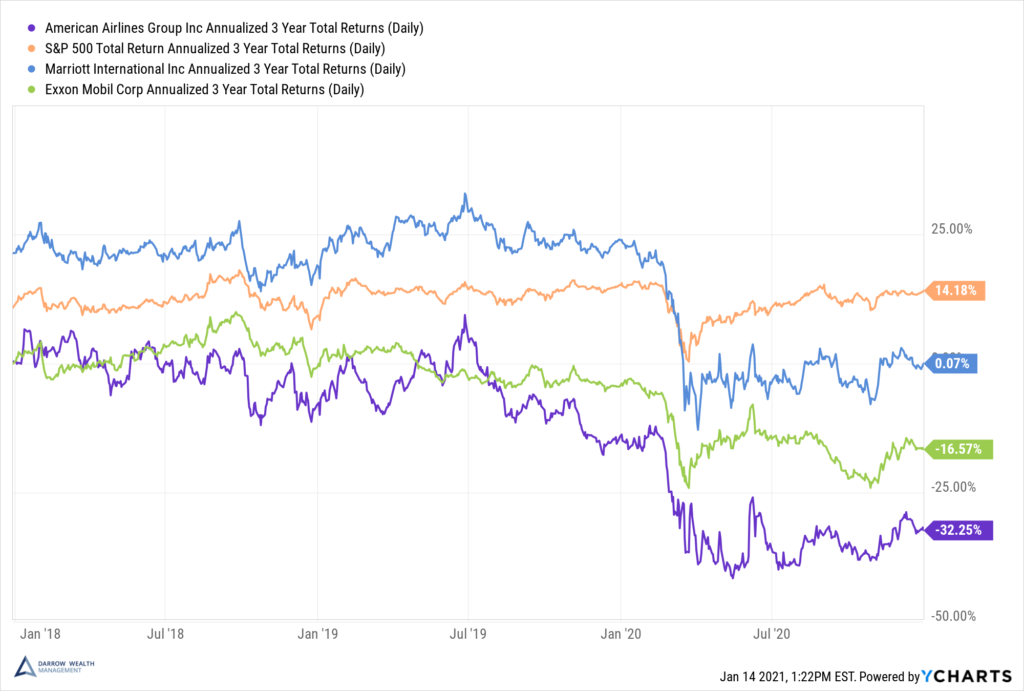

Annualized 3-year total returns (2018 – 2020)

2020 was definitely an outlier year, but sometimes the impact of a really bad year can linger and erase years of previous on-paper gains.

Should You Keep Investing Through a Recession?

Should You Go To Cash Until The Market Recovers Or Ride It Out?

Anyone can get hurt from holding too much of one stock. For any reason.

The current global crisis was not sparked by misappropriated funds, bad business models, increased competition, corporate scandals, or any other type of misstep that could have been avoided. It wasn’t something they could control.

For the employees of these companies, and other small businesses around the world, the impact to their financial lives could be devastating.

Of course, with big risk comes big reward, and even in the current circumstances, there are some companies who have done very well amid the crisis. For example, Zoom, maker of video conferencing software, has seen their stock nearly double YTD.

A windfall from selling stock proceeds is a great way to build wealth, but you have to have a plan for the realistic possibility that it never materializes.

Unwinding a concentrated stock position

In general, no more than 10% of your net worth should be in employer stock. If your compensation package is too heavily weighted in company stock options or awards you can try to renegotiate to receive more cash compensation.

Here are common ways individuals hold too much employer stock:

- Compensation package is too heavily weighted in stock options or restricted stock

- Company 401(k) plan match is in shares of the employer’s publicly traded stock instead of cash

- When stock options are exercised or awards are vested, shares are held with no plan to systematically liquidate the shares

- Participating too heavily in an employee stock purchase plan

- Buying stock directly from an exchange for a personal brokerage account

What to do if you’ve over-invested in company stock

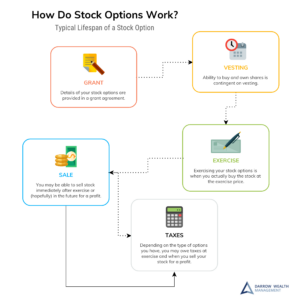

How you own the stock will dictate your options to divest:

- Stock options. You may be able to sell shares immediately after exercising options and profit in a quick, low-risk transaction. There are tradeoffs from a tax standpoint though, so speak with your financial advisor and tax professional beforehand.

- Restricted stock units (RSUs). You can’t diversify unvested awards. But after vesting, you’re free to divest of the company stock (assuming your company isn’t going through an IPO or merger or acquisition). Consider selling at least a portion of your stock after it vests to diversify into other investments.

- Own stock in an employee stock purchase plan (ESPP). If you participate in an ESPP, you can reduce your concentration in company stock in two ways. Reducing/ eliminating future participation in the plan and asking when you can sell shares you already own in the ESPP. The tax consequences of selling shares will depend on whether the plan is a qualified Section 423 plan or not. Work with your financial advisor and tax professional to evaluate the tax consequences and develop a plan to liquidate the shares.

- Elective stock purchases in your retirement plan. There’s typically a lot of flexibility to divest from funds you selected. Depending on plan documents, you may be able to buy and sell at any point or update your allocation quarterly.

- Non-elective or matching contributions from your employer. If your employer makes matching contributions to your retirement account in company stock instead of cash, you may not be able to diversify right away. Depending on the plan, you may have to wait until you have three years of service at the firm to sell the shares. This isn’t universally the case though. Some companies may allow you to sell shares in your retirement plan immediately.

Your investing strategy deserves more than thoughts and prayers

What can happen if you own too much of your company’s stock can be devastating. Having faith in your employer is a good thing – but having all your eggs in one basket usually is not. If you’re holding onto your equity in hopes of a large windfall, make sure you’re also comfortable with the possibility of losing your on-paper profits too.

Financial markets can be volatile, and news of a global pandemic, merger, acquisition, and shifts in legislation and commodity prices can have a dramatic impact on stock prices, sometimes overnight.